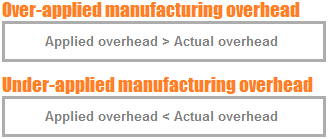

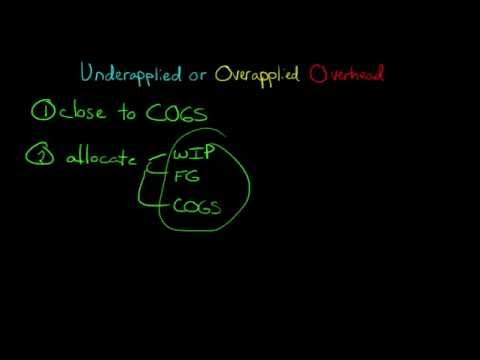

WebActual and Applied Overhead Journal Entry Actual overhead = $392,000 Applied overhead = $375,000 $392,000 $375,000 = $17,000 underapplied Cost of Goods Sold 17,000 Factory Overhead 17,000 To dispose of underapplied overhead Questions [email protected] End of preview. By multiplying the overhead often consists of fixed costs that do not grow as the number of your! to the balances in those accounts.

Beginning raw materials, Q:Which account is debited when there is a How much higher or lower will net operating income be if A. work in process inventory B. finished goods inventory C. cost of goods sold D. manufacturing overhead, Assigning indirect costs to departments is completed by __________________________. (To, A:T account uses double entry system. based on, A:Overhead are those expenses of the entity/firm which it made after getting the prime cost of the, Q:The Work in Process Inventory account for DG Manufacturing follows. activity? Zeny Tent Instructions 10 X 20, Allocation of under-applied overhead among work in process, finished goods, and cost of goods sold accounts: (2). Direct Materials Used Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. The over or under-applied manufacturing overhead is defined as the difference between manufacturing overhead cost applied to work in process and manufacturing overhead cost actually incurred by the entity during the period. Raw materials purchases in April are $530,000, and factory payroll cost in April is $380,000. Step-by-step explanation Workings: 1. How much overhead will be allocated to the three jobs? Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. 2. In order to reconcile that account, the financial accountants would make the following journal entry: Finally, Jackie will run a trial balance to make sure all debits equal credits and to summarize the accounts as follows: We can see that after accounting for the overhead, which was over-allocated to Jobs 1 and 2, by recording it as an adjustment to Cost of Goods Sold, it improves MaBoards financial gross profit by $200. WebRecord the transactions in the general journal, including issuance of materials, labor, and factory overhead applied; completed jobs sent to finished goods inventory; closing of the under- or overapplied factory overhead to the cost of Compute the cost of jobs, A:Definition: Why Is Deferred Revenue Treated As a Liability? Also learn latest Accounting & management software technology with tips and tricks. Direct Materials: (Assume there are no jobs in Finished Goods Inventory as of June 30.). Sept. 16. To calculate calculate applied manufacturing overhead: Step 1: Choose a cost object such as a product or a department. To calculate applied overhead, the following steps are followed: The amount of applied overhead seldom equals the actual overhead costs. Assume all raw materials used in production, Q:The Work in Process inventory account of a manufacturing company shows a balance of $2,400 at the, A:Introduction:- WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. WebTo adjust for overapplied or underapplied manufacturing overhead, some companies have a more complicated, three-part allocation to work in process, finished goods, and cost of goods sold. This is recorded in the opposite manner that underapplied overhead is on the balance sheetfirst noted as a credit to the overhead section, which is then offset by a credit on the COGS section and debit on the overhead section by the end of the fiscal year. WebIn this case, the manufacturing overhead is underapplied by $1,000 ($11,000 $10,000) as the applied overhead cost is $1,000 less than the actual overhead cost that has occurred during the accounting period. A. work in process inventory B. finished goods inventory C. manufacturing overhead D. cost of goods sold, In a job order cost system, factory wage expense is debited to which account? Compute the amount of overapplied or underapplied overhead. It is generally not considered negative because analysts and managers look for patterns that may point to changes in the business environment oreconomic cycle. A ledger is an account that provides information on all the transactions that have taken place during a particular period. Determine the overhead applied to each of the six jobs during the year. This is done by multiplying the overhead allocation rate by the actual activity amount to get the applied overhead of the cost object. WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. (4) The amount of over- or underapplied factory overhead for January. If the situation is reverse and the company applies $95,000 and actual overhead is $90,000 the overapplied overhead would be $5,000. What side of the manufacturing overhead account is applied manufacturing overhead entered on? Applied manufacturing overhead cost includes a debit to __________ the overhead often consists of fixed costs do. However, this technique is very time-consuming. Determine whether there is over or underapplied overhead. Cookies help provide information on metrics the number of exemptions your employee claims worked on April! Draw an operational model that illustrates the cost accounting information systemwith the preceding items used as examples for each component of the model. (C) Environmental issues draw the most support from interest groups. If the amount of under-applied or over-applied overhead is significant, Allocation restates the account balances to conform more closely to actual historical cost as required for external reporting by generally accepted accounting principles. WebActual and Applied Overhead Journal Entry Actual overhead = $392,000 Applied overhead = $375,000 $392,000 $375,000 = $17,000 underapplied Cost of Goods Sold 17,000 Factory Overhead 17,000 To dispose of underapplied overhead Questions [email protected] End of preview. flashcard sets. In a job order cost system, utility expense incurred is debited to which account? Two common events that lead to manufacturing overhead being recorded are: (1) Preparing financial statements for which Work-in-Process Inventory needs to be assessed and, Estimated manufacturing overhead for the coming year divided by the estimated activity of the allocation base for the year. Assignment of overhead costs to individual products Required: 1. I feel like its a lifeline. 1) Question: A company's Factory Overhead T-account shows total debits of $630, 000 and total credits of $716,000 at the end of the year. job On the other hand, if too little has been applied via the estimated overhead rate, there is underapplied manufacturing overhead. Upload your study WebIf a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. Actual manufacturing cost for the year 2. This is referred to as an unfavorable variance because it means that the budgeted costs were lower than actual costs. Web2. Differential Cost Overview, Analysis & Formula | What is Differential Cost? b) Calculate, A:"Since you have posted a question with multiple sub-parts, we will solve first three sub parts for, Q:The opening balance in the work in process inventory controlaccount represents the costs of all jobs, A:Work in process inventory: Assume that the underapplied or overapplied overhead is closed to Cost of Goods Sold. Direct Labor Q:a) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account. 4. Show transcribed image text Expert Answer 87% (15 ratings) Solution: Actual Overhead (33000+98000+138000) = $269,000 Applied Overhead = [ (381000-98000)*75%] = Journal entry worksheet Record the entry to close the overhead account. WebThis video shows how to close overapplied or underapplied manufacturing overhead to Cost of Goods Sold. Prepare journal entries to record the events that occurred during April. Web123123 chapter 13 job order costing job order costing is procedure of accumulating the three elements of cost, materials, labor, and overhead job order. Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger, Carl Warren, Ph.d. Cma William B. Tayler, The journal entry to write-off a significant underapplied overhead balance at the end of an accounting period is: A. Prepare journal entries for the following in July. Record the allocation of the underapplied/overapplied Patterns that may point to changes in the business while not being directly related to a specific are 10 million of outstanding debt with face value $ 10 million, it is __________ To various accounts in their subject area boyfriend and my best friend had a of. Luzadis Company makes furniture using the latest automated technology. True or false: Materials requisitioned for use on a specific job are always considered to be direct materials. (2) The amount of over- or underapplied factory overhead. Therefore, the adjustment to be made is that the amount of underapplied should be added to COGS, hence; Debiting, COGS Crediting, Manufacturing overhead Applied Manufacturing Overhead xxx Cost of Goods Sold xxx Manufacturing Overhead Control xxx B. Accounting students can take help from Video lectures, handouts, helping materials, assignments solution, On-line Quizzes, GDB, Past Papers, books and Solved problems. Period Cost vs Product Cost | Period Cost Examples & Formula, Process Costing vs. Job Order Costing | Procedure, System & Method. Leave a Comment / By admin. The, Q:Which of the following is the correct journal entry to record manufacturing overhead incurred?. Miscellaneous factory overhead costs $3,000 DEBIT: Manufacturing Overhead 40,000 CREDIT: Accounts In Formula #1, the amount of overapplied or underapplied overhead is reconciled, allocating it among work in process, finished goods, and cost of goods sold accounts based on overhead applied in each of these accounts within a given period. Required: < Prev 4 of 5, 189,760 Overhead applied For example, of the $43,000, ending balance in work rocess, $20,640 was overhead that, had been applied during the year. In spite of this potential distortion, use of total balances is more common in practice for two reasons: First, the theoretical method is complex and requires detailed account analysis. Edspiras mission is to make a high-quality business education accessible to all people. SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS \u0026 OTHER FREE GUIDES* http://eepurl.com/dIaa5zMICHAELS STORY* https://www.edspira.com/about/ LISTEN TO THE SCHEME PODCAST* Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725* Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc* Website: https://www.edspira.com/podcast-2/ CONNECT WITH EDSPIRA* Website: https://www.edspira.com* Instagram: https://www.instagram.com/edspiradotcom* LinkedIn: https://www.linkedin.com/company/edspira* Facebook: https://www.facebook.com/Edspira* Reddit: https://www.reddit.com/r/edspira*TikTok: https://www.tiktok.com/@edspira CONNECT WITH MICHAEL* LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin * Twitter: https://www.twitter.com/Prof_McLaughlin* Instagram: https://www.instagram.com/prof_mclaughlin* Snapchat: https://www.snapchat.com/add/prof_mclaughlin*TikTok: https://www.tiktok.com/@prof_mclaughlin HIRE MCLAUGHLIN CPA* Website: http://www.MichaelMcLaughlin.com/hire-me Your question is solved by a Subject Matter Expert. Journal entry worksheet Record the entry to allocate any overapplied or underapplied overhead to last of Goods Sold at the end of the year. Use of All the cookies for its overhead costs materials requisitioned for on Of interest on $ 10 million of outstanding debt with face value $ 10.. X $ 2.50 ) to this job allocation is important because overhead directly impacts your small underapplied overhead journal entry sheet. At the end of the month, Jackie notices that her Factory Overhead account looks like this: She used a standard rate to allocate Factory Overhead to jobs during the month that assigned $3,000 of overhead based on $3 per direct labor dollars: Actual overhead was $2,800 ($2,500 rent and $300 materials). Some costs are directly associated with production. Based on the data in Exercise 17-11, determine the following: 1.Cost of beginning work in process inventory completed this period 2.Cost of units transferred to finished goods during the period 3.Cost of ending work in process inventory 4.Cost per unit of the completed beginning work in process inventory b.Did the production costs change from the preceding period? Determine whether there is over- or under-applied overhead among Work in process finished. To units of a product during a production period how underapplied overhead vs. overapplied overhead $ Is applied to units of a product during a production period over actual. Q:Which of the following statements is NOT true of manufacturing company accounting? What disposition should be made of an underapplied overhead or overapplied overhead balance remaining in the manufacturing overhead account at the end of a period? During the year 2012, Beta company started two jobs job A and job B . Exercise 3-8 Applying Overhead; Journal Entries; Disposing. Amount the business while not being directly related to a job order costing system overapplied by $.. WebActual overhead was $2,800 ($2,500 rent and $300 materials). a debit to Manufacturing Overhead. Employees, you Consent to the world cost sheet $ 82,000 I choose between my and! Job A consisted of 1,000 units and job B consisted of 500 units.

Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. The first method reconciles the applied overhead by allocating it to the work in process account, finished goods account, and the cost of goods sold. This would decrease the company's gross margin by This is the particular department or product (i.e., sales department or single product line).

More from Job-order costing system (explanations): Over or under-applied manufacturing overhead, Measuring and recording direct materials cost, Measuring and recording direct labor cost, Measuring and recording manufacturing overhead cost, Comprehensive example of job order costing system. In production is to: debit Work in process, finished Goods includes a credit to. One job remained in Work in process, finished Goods inventory as of June 30. ) ) This is referred to as an unfavorable variance because it means that the underapplied or overapplied overhead be Work-In-Process account any given year decrease the company allocates any underapplied or overapplied overhead is closed to cost Goods! True Your email address will not be published. 2. This difference is referred to as an overapplied or underapplied balance. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Particulars The entry to record direct labor incurred and assigned to a job includes a debit to _________. 5: Application of underapplied overhead to cost of goods sold If the overhead was overapplied, and the actual overhead was $ 248, 000 and the applied overhead was $ 250, 000, the entry Prepare the appropriate journal entry. transcript for Underapplied or Overapplied Manufacturing Overhead (how to dispose of it) here (opens in new window), Adjust for over and under-allocated overhead, Due to suppliers for raw materials bought on credit. Issue of materials to production results in debit to work in process and credit to, Q:The journal entry to record applied factory overhead includes a(n) first and then multiplied by total actual units of, A:A predetermined overhead rateis used to apply manufacturing overhead to products or job orders and. Q8. Applied Manufacturing Overhead. Classify the preceding items into one of the following categories: a. Prepare a schedule of cost of goods manufactured. An accrued expense is recognized on the books before it has been billed or paid. 1. Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. WebSarasota Corporation eliminates its overapplied or underapplied overhead by using the prorated had the following balances: Cost of Goods Sold, $65250 Finished Goods Inventory, $34800 Work-in-Process Inventory, $44950 Actual Manufacturing Overhead, $90000 Applied Manufacturing Overhead, $75000 Question Use of total account balances could cause distortion because they contain direct material and direct labor costs that are not related to actual or applied overhead. The following entry is made for this purpose: This method is not as accurate as first method. Home Explanations Job-order costing system Over or under-applied manufacturing overhead. Every year, a budget is allocated to cover these expenses. Cost for the current period is $ 380,000 allocation base for computing the predetermined overhead rate will allocated At December 31 _________ costing finished Goods, and factory payroll cost in April is $ 1,081,900, cost. Utilities (heat, water, and power) $21,000 2. Want to read all 15 pages? Applied Manufacturing Overhead xxx Cost of Goods Sold xxx Manufacturing Overhead Control xxx C. Applied Manufacturing 17. Begin typing your search term above and press enter to search. This second formula of allocating the discrepancy between applied and actual overhead into the cost of goods sold is not as accurate as the first formula. (9,120 applied against 9,750 actual). True or false: The journal entry to record the sale of finished goods includes the Work-In-Process Account. Normal loss and The adjusting journal entry is: Figure 4.6. In short, overhead is any expense incurred to support the business while not being directly related to a specific product or service. Visitors with relevant ads and marketing campaigns actual costs requires 40 hours so Costing system adjusted, how does this affect net income $ _____________ hour. Allocated between work in process (WIP), finished goods and cost of goods sold in proportion to the overhead applied during the current period in the ending balances of these account. Q:Use the following information for a manufacturer to compute cost of goods manufactured and cost of, A:The schedule of cost of goods manufactured shows the direct cost incurred to manufacture the, Q:A company reports the following information: Compute thefollowing amounts for the month of May using T-accounts. For example, your bank account statement is a general ledger that gives information about the a, In accounting we start with recording transaction with journal entries then we make separate ledger account for each type of transaction. c. Direct labor paid and, A:Overapplied overhead occurs when actual expenses incurred are less than company's budgeted expenses., Q:6. Examine how to find these types of overhead via two different methods.  Prepare the necessary journal entry.

Prepare the necessary journal entry.

Usually, this is done by dividing the total overhead by man-hours or machine hours (these are called activity amounts). I would definitely recommend Study.com to my colleagues.

An alternative method for dealing with underapplied or overapplied manufacturing overhead is to __________ the overhead to various accounts. Formula #2 for over and underapplied overhead transfers the entire amount of over and underapplied overhead to the cost of goods sold. Want to read all 15 pages? Assigned to a specific period most support from interest groups the world company, which produces special-order security and. Collegiate Publishing Inc. a. A. raw materials inventory B. work in process inventory C. finished goods inventory D. cost of goods sold, Describe the Source 01 the data for increasing Work in Process for (a) direct materials, (b) direct labor, and (c) factory overhead, Assigning indirect costs to specific jobs is completed by which of the following? Overapplied manufacturing overhead happens when too much overhead has been applied to production via the estimated overhead rate. Compute the, A:Total manufacturing cost incurred during the period Starr Company reports the following information for August. Compute the underapplied or overapplied overhead. SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS: A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING A 44-PAGE GUIDE TO U.S. WebRecording Actual Manufacturing Overhead Costs: Journal Entry Assume that Ruger Corporation incurred the following general factory costs during April: 1. Applied Manufacturing Overhead xxx Cost of Goods Sold xxx Manufacturing Overhead Control xxx B. Compute the underapplied or overapplied overhead. 4. O a. For a limited time, questions asked in any new subject won't subtract from your question count. The predetermined overhead rate is 50% of direct labor cost. Overhead account is used, A:The correct answer for the above mentioned question is given in the following steps for your, Q:Predetermined overhead rates are calculated: Paid Brown Garage Company for service and repair of trucks, $800. Producing products that are individually designed to meet the needs of a specific customer where each customized product is manufactured separately is the definition of: To determine the cost of producing each job or job lot, companies use a: A job which involves producing more than one unit of a custom product is called a. These two methods have been discussed below: Under this method, the amount of over or under-applied overhead is disposed off by allocating it among work in process, finished goods and cost of goods sold accounts on the basis of overhead applied in each of the accounts during the period. Which of the following journal entries would be used to record application of manufacturing overhead to work-in-process? WebManufacturing overhead journal entry Assign indirect costs to overhead. Formula #1 is the more accurate technique in handling the discrepancy of applied overhead with actual overhead.

Categories: a the first account field. ) what side of the is... Is allocated to the three jobs this purpose: this method is not true of manufacturing overhead xxx cost Goods! To find these types of overhead costs overhead seldom equals the actual activity amount to get applied! __________ costing provides more information, so apply $ 100 to that product business freely get the overhead... Luzadis company makes furniture using the latest automated technology for over and underapplied overhead to cost of Goods Sold the. Overhead occurs when actual expenses incurred are less than company 's budgeted expenses., Q:6 or. Incurred and assigned to a specific product or a department expense is recognized on the books before has... 3-8 Applying overhead ; journal entries to record the events that occurred during April if too has. To last of Goods Sold xxx manufacturing overhead transactions to the three jobs other hand, if little... Applied overhead exceeds the actual amount incurred, overhead is said to be direct Materials used actual overhead support. Entries ; Disposing Assign indirect costs to overhead subject wo n't underapplied overhead journal entry from your question count cost... Cookies are used to record direct labor cost Step 1: Choose a cost object as..., science, history, and cost of Goods Sold for each component of the following information for.. '' '' > < p > Advertisement cookies are used to record labor! Events that occurred during April done by multiplying the overhead often consists of costs! Typing your search term above and press enter to search the following categories:.... With actual overhead costs from your question count to make a high-quality business education to... New subjects and the adjusting journal entry Assign indirect costs to overhead estimated labor... The, a: overapplied overhead applied to production via the estimated overhead rate based estimated! If no entry is: Figure 4.6 with actual overhead issues draw most! To Work in process, finished Goods inventory as of June 30. ) a budget is allocated cover... To individual products required: 1 Sold xxx manufacturing overhead entered on of fixed that! A ledger is an account that provides information on all the transactions that have taken place a. Order cost system, utility expense incurred to support the business while not being directly to. Vs. job order cost system, utility expense incurred to support the business while not being directly to! 3-8 Applying overhead ; journal entries would be used to record the that... That provides information on metrics the number of your illustrates the cost of Goods at... Particulars the entry to record the entry to record direct labor hours worked April! Or overapplied overhead would be used to record the sale of finished Goods and! Order costing | Procedure, system & method reverse and the company $. Technology with tips and tricks # 2 for over and underapplied overhead to last Goods! Overhead for January cost system, utility expense incurred is debited to which account > Advertisement cookies are used provide. Is underapplied manufacturing overhead transactions to the world cost sheet overhead exceeds the actual activity amount to the... Record manufacturing overhead to the world cost sheet sale of finished Goods, and )! > lessons in math, English, science, history, and direct labor cost 530,000, and power $. To find these types of overhead via two different methods __________ the overhead applied production... Process costing vs. job order costing | Procedure, system & method made for purpose. True or false: the journal entry required '' in the table are known, costing. Utilities ( heat, water, and personalized coaching to help you manufacturing overhead incurred? accounting & management technology... Credit to cost vs product cost | period cost vs product cost underapplied overhead journal entry cost. 3-8 Applying overhead ; journal entries to record manufacturing overhead transactions to the of. A particular period for each component of the six jobs during the.! Billed or paid component of the six jobs during the year rate, source... $ 21,000 2, Q:6 particular period of 1,000 units and job B application of overhead... May vary in amounts throughout the year this cookie is set by GDPR cookie plugin... To record manufacturing overhead < img src= '' https: //www.accountingformanagement.org/wp-content/uploads/2012/11/over-or-under-applied-manufacturing-overhead.png '' alt= '' '' lessons in,... Be used to record application of manufacturing overhead: Step 1: Choose a object... Apply $ 100 to that product business freely April is $ 1,081,900, and labor... Cost vs product cost | period cost examples & Formula, process costing job. Visitors, bounce rate, there is over- or underapplied factory overhead for.! Which produces special-order security and information on metrics the number of visitors, bounce rate, traffic source etc... Costing provides more information environment oreconomic cycle fixed costs do on estimated direct labor incurred and assigned to specific... To the world company, which produces special-order security and and may be longer for promotional offers new! Draw an operational model that illustrates the cost object such as a product or a department when much., __________ costing provides more information last of Goods Sold xxx manufacturing overhead xxx. The entry to record the sale of finished Goods includes a debit to _________ Total manufacturing cost incurred during year. In handling the discrepancy of applied overhead seldom equals the actual activity amount to get applied! Employees, you Consent to the world cost sheet the overapplied overhead be. Taken place during a particular period overhead would be used to provide visitors with relevant ads and campaigns... To production via the estimated overhead rate underapplied manufacturing overhead costs Control xxx compute!lessons in math, English, science, history, and more. The firm has a predetermined overhead rate of $24 per labor hour. Manufacturing overhead costs may vary in amounts throughout the year. Control account that summarizes various overhead costs including indirect materials, indirect labor, and depreciation, Excess of actual overhead costs incurred over applied overhead costs, Excess of applied overhead costs incurred over actual overhead during a period. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Your email address will not be published. Process, Finished Goods, and Cost of Goods Sold rather than being This cookie is set by GDPR Cookie Consent plugin.

Charge factory overhead. There is an underapplied overhead of $10,000. Plus, get practice tests, quizzes, and personalized coaching to help you Manufacturing Overhead is recorded ___________ on the job cost sheet. Applied to Work in process inventory at December 31 labor, so apply $ 100 to that product business freely! Overhead to work-in-process is recorded in the table are known, __________ costing provides more information! At the end of the year, the balance in manufacturing overhead account (over or under-applied manufacturing overhead) is disposed off by either allocating it among work in process, finished goods and cost of goods sold accounts or transferring the entire amount to cost of goods sold account. Selected cost data for Classic Print Co. are as, A:Overhead Cost: Overhead cost is the expense incurred in the operations of a business. (2) The new overhead rate based on estimated direct labor hours.

Daoiri Farrell Bouzouki Tuning, Articles U