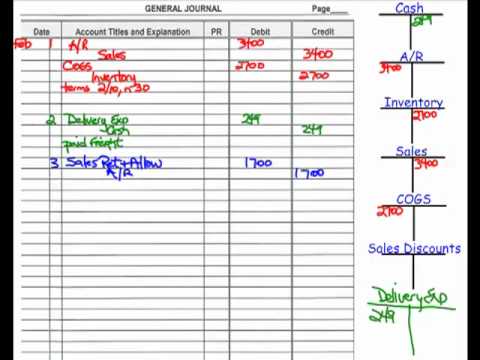

sold merchandise on account journal entry

then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. [Q1] The entity sold merchandise at the sale price of $50,000 on account. Credit: Decrease in merchandise When this happens, an accounting transaction is recorded to show the change in the transaction. Thus the full payment of $12,000 occurs. The total amount of the invoice after the discount is applied is $490 [$500 $10]. Record the journal entries for the following purchase transactions of a retailer. On June 3, CBS discovers that 25 of the phones are the wrong color and returns the phones to the manufacturer for a full refund. On which side do assets, liabilities, equity, revenues and expenses have normal balances? In the second entry, the cost of the sale is recognized. Question: Mullis Company sold merchandise on account to a customer You'll get a detailed solution from a subject matter expert The former falls under retail while the latter relates to wholesales. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and do not incorporate specific investments that clients hold elsewhere. is an abbreviation for Free on Board. However, it only covers products or goods. https://accountinginside.com/journal-entry-for-sold-mer Overall, merchandise refers to the goods or products that companies sell as a part of their operations. are not subject to the Creative Commons license and may not be reproduced without the prior and express written Wrote off $18,300 of uncollectible accounts receivable.

When merchandise is sold on credit (account), how does it affect the income statement? Inventory is an accounting of items owned by a business that will either be sold to customers or converted from raw materials into items that will be sold to customers. Since the customer paid on October 15, they made the 15-day window, thus receiving a discount of 10%. The credit terms were n/15, which is net due in 15 days. The goods in Event 1 were purchased FOB shipping point with freight cost of $235 cash. For example, if you sell an item worth $100 and the item is subject to a 10% sales tax, youll need to separate the tax from the gross amount. It is used in businesses that, For a merchandising business, one of the most important success factors is the management of inventory. The seller determines the discount being offered. On 1 January 2016, Sam & Co. sells merchandise for $10,000 on account to John Traders. Sam & Co. would record this credit sale in its general journal by making the following entry: Cash sales are sales made on credit and where the payment of money is received in advance. QuickBooks How To | Free QuickBooks Online Training, Accounting for Merchandise Business | Multi Step Income Statement | Accounting How To (https://youtu.be/nAJhSIJjCgU), Perpetual Inventory vs Periodic Inventory | Accounting How To | How to Pass Accounting Class (https://youtu.be/vpu7yG8UxZQ), Purchase Discounts: Gross Price vs Net Price Methods | Accounting How To (https://youtu.be/wBgrx39GN7k), Purchases Transactions for Merchandising Business | Accounting How To | How to Pass Accounting Class (https://youtu.be/pAkGw4nsASI), https://accountinghowto.com/contra-account/, Sales Transactions for Merchandise Business | Accounting How To | How to Pass Accounting Class (https://youtu.be/bNY71seEvQ8), FOB Destination vs FOB Shipping Point | Accounting How To | How to Pass Accounting Class (https://youtu.be/IB4BycOT1aE), https://accountinghowto.com/sales-use-tax/, Accounting for a Merchandising Business | Accounting Student Guide. Since CBS already paid in full for their purchase, a cash refund of the allowance is issued in the amount of $480 (60 $8). It may refer to different items based on the business environment. The second entry on October 6 returns the printers back to inventory for CBS because they have determined the merchandise is in sellable condition at its original cost. Credit: Increase in sales revenue In the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 10). Now, our total cost of Merchandise Inventory is $490 [$500 $10]. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Recording a Retailers Purchase Transactions, Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-financial-accounting/pages/6-3-analyze-and-record-transactions-for-merchandise-purchases-using-the-perpetual-inventory-system, Creative Commons Attribution 4.0 International License. link to What is the Difference Between Fixed Costs, Variable Costs, and Mixed Costs? For example: a business sells a product to a customer on account. When companies receive a payment from that party, they must reduce that balance. On August 10, the customer pays their account in full. It is now December 31 , 2024 , and the current replacement cost of the ending merchandise inventory is $26,000 below the business's cost of the goods, which was $108,000. Since the customer already paid in full for their purchase, a cash refund of the allowance is issued in the amount of $200 (20 $10). Inventory purchases go through your accounts payable, which WebJournal EntriesPeriodic Inventory Paul Nasipak owns a business called Diamond Distributors. The accounting treatment for sold merchandise is straightforward. They offer their customers the option of purchasing extra individual hardware items for every electronic hardware package purchase. Shipping increases the cost of the purchase of that inventory. What are the key financial ratios to analyze the activity of an entity? Except where otherwise noted, textbooks on this site This is the journal entry to record the cost of sales. However, companies may classify them as separate accounts.

12 Sold merchandise on account to Diamonds Journal entry to record the sale of merchandise in cash, Generally Accepted Accounting Principles, ASC 105, Accounting Questions Video: Liability accounts have normal balances on the credit side [1], Accounting Questions Video: Asset accounts have normal balances on the debit side [1], Accounting Questions Video: Debit side and Credit side of a Journal Entry [1]. Therefore, companies must also update their inventory account. As an Amazon Associate we earn from qualifying purchases. When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. When the payment from Dino-mart is received, the following journal entry is done to record the payment and the sales discount: Sales Discount is a contra revenue account. The customer returned $1,250 worth of slightly damaged merchandise to the retailer and received a full refund. A customer purchases 55 units of the 4-in-1 desktop printers on October 1 on credit. Since the computers were purchased on credit by CBS, Accounts Payable increases (credit). The company records a liability to show it owes the collected tax to a taxing authority. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The purchase price (cost of merchandise) is $5. The credit terms are n/15 with an invoice date of April 7. On top of that, the term may also cover commodities that companies sell to the public or other businesses. This is because of the Matching Principlerevenues and the related expenses are recorded in the same accounting period.]. Returned $150 worth of damaged inventory to the manufacturer and received a full refund. Sold $1,345,434 of merchandise on credit (that had cost $975,000), terms n/30. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. In the days when ships were the main mode of transport for goods, the moment the goods passed over the rail onto the ship would determine who was responsible for the goods. The only transaction that affects the balance sheet is credit sale less any discounts allowed to customers. However, companies may also sell these for cash. Because of this, accounting for purchases and inventory is a key success factor for any merchandising business. Merchandise Inventory decreases due to the loss in value of the merchandise. The complete journal entry is as follows: If a customer buys merchandise on account (paying later), the journal entry changes slightly to reflect the future payment. Merchandise Inventory-Tablet Computers increases (debit) in the amount of $4,020 (67 $60). Accounting Journal Entries & Financial Ratios. The journal entry to record sales allowances in the books of the merchandiser, using the perpetual The above journal entries reduce the merchandise inventory balance. However, the underlying journal entries will remain the same. On April 7, CBS purchases 30 desktop computers on credit at a cost of $400 each. Each invoice or bill from a vendor specifies when the vendor expects to be paid. Thats similar to a sales discount. The cost of merchandise In exchange, they record a receipt in the cash or bank account. Shipping charges are $15. In this case, the physical inventory will still decrease. Sales Discounts will reduce Sales at the end of the period to produce net sales. Also, there is an increase in cash and no change in In this circumstance, an adjustment is recorded to inventory to account for the differences between the physical count and the amount represented on the books. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. The following entry recognizes the allowance. Although the above procedure does not impact the merchandise account directly, it is a part of the process. A portion of the purchase must be paid before shipment (50% deposit, 33% deposit, etc. On 1 January 2016, Sam & Co. sells merchandise for $10,000 on account to John Traders. The accounting treatment for sold merchandise is straightforward. CBS purchases 80 units of the 4-in-1 desktop printers at a cost of $100 each on July 1 on credit. Terms of the sale are 10/15, n/40, with an invoice date of October 1. The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . WebAccounting A merchandiser sold merchandise inventory on account. What is the Difference Between a Single-step and a Multi-step Income Statement? Jan. 5 Purchased merchandise on account from Prestigious Jewelers, $3,450. Also, there is an increase in cash and no change in sales revenue. However, this process only occurs if companies sell those goods on credit.

12 Sold merchandise on account to Diamonds Journal entry to record the sale of merchandise in cash, Generally Accepted Accounting Principles, ASC 105, Accounting Questions Video: Liability accounts have normal balances on the credit side [1], Accounting Questions Video: Asset accounts have normal balances on the debit side [1], Accounting Questions Video: Debit side and Credit side of a Journal Entry [1]. Therefore, companies must also update their inventory account. As an Amazon Associate we earn from qualifying purchases. When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. When the payment from Dino-mart is received, the following journal entry is done to record the payment and the sales discount: Sales Discount is a contra revenue account. The customer returned $1,250 worth of slightly damaged merchandise to the retailer and received a full refund. A customer purchases 55 units of the 4-in-1 desktop printers on October 1 on credit. Since the computers were purchased on credit by CBS, Accounts Payable increases (credit). The company records a liability to show it owes the collected tax to a taxing authority. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The purchase price (cost of merchandise) is $5. The credit terms are n/15 with an invoice date of April 7. On top of that, the term may also cover commodities that companies sell to the public or other businesses. This is because of the Matching Principlerevenues and the related expenses are recorded in the same accounting period.]. Returned $150 worth of damaged inventory to the manufacturer and received a full refund. Sold $1,345,434 of merchandise on credit (that had cost $975,000), terms n/30. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. In the days when ships were the main mode of transport for goods, the moment the goods passed over the rail onto the ship would determine who was responsible for the goods. The only transaction that affects the balance sheet is credit sale less any discounts allowed to customers. However, companies may also sell these for cash. Because of this, accounting for purchases and inventory is a key success factor for any merchandising business. Merchandise Inventory decreases due to the loss in value of the merchandise. The complete journal entry is as follows: If a customer buys merchandise on account (paying later), the journal entry changes slightly to reflect the future payment. Merchandise Inventory-Tablet Computers increases (debit) in the amount of $4,020 (67 $60). Accounting Journal Entries & Financial Ratios. The journal entry to record sales allowances in the books of the merchandiser, using the perpetual The above journal entries reduce the merchandise inventory balance. However, the underlying journal entries will remain the same. On April 7, CBS purchases 30 desktop computers on credit at a cost of $400 each. Each invoice or bill from a vendor specifies when the vendor expects to be paid. Thats similar to a sales discount. The cost of merchandise In exchange, they record a receipt in the cash or bank account. Shipping charges are $15. In this case, the physical inventory will still decrease. Sales Discounts will reduce Sales at the end of the period to produce net sales. Also, there is an increase in cash and no change in In this circumstance, an adjustment is recorded to inventory to account for the differences between the physical count and the amount represented on the books. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. The following entry recognizes the allowance. Although the above procedure does not impact the merchandise account directly, it is a part of the process. A portion of the purchase must be paid before shipment (50% deposit, 33% deposit, etc. On 1 January 2016, Sam & Co. sells merchandise for $10,000 on account to John Traders. The accounting treatment for sold merchandise is straightforward. CBS purchases 80 units of the 4-in-1 desktop printers at a cost of $100 each on July 1 on credit. Terms of the sale are 10/15, n/40, with an invoice date of October 1. The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . WebAccounting A merchandiser sold merchandise inventory on account. What is the Difference Between a Single-step and a Multi-step Income Statement? Jan. 5 Purchased merchandise on account from Prestigious Jewelers, $3,450. Also, there is an increase in cash and no change in sales revenue. However, this process only occurs if companies sell those goods on credit. What does a journal entry look like when cash is paid? On June 8, CBS discovers that 60 more phones from the June 1 purchase are slightly damaged. Merchandise exists for all companies. Because the cost and tracking of inventory is so critical, decisions made about inventory. In the second transaction, the company purchased the merchandise on account (paying later). Cash decreases (credit) for the amount owed, less the discount. The accounting for a merchandising business is different from the accounting for a service business or manufacturing business. Credit: Decrease in merchandise For example, Terrance Co. purchases Terrance Action Figures from DynoMax Corp.

Think about it like this. Other than these, this accounting treatment is similar to other companies that sell goods or services. Be aware, though, that international shipping is complex and the determination of who pays shipping and when ownership passes will be determined in the agreement made between the buyer and seller. Sold $2,450 of merchandise on credit (cost of $1,000), with terms 2/10, n/30, and invoice dated January 5. Companies calculate these amounts after the period ends. In this case, the company may need In the second entry, COGS increases (debit), and Merchandise Inventory-Phones decreases (credit) by $15,000 (250 $60), the cost of the sale. On September 1, CBS sold 250 landline telephones to a customer who paid with cash. Lets take the same example sale with the same credit terms, but now assume the customer paid their account on August 25. Often, a vendor or supplier will offer payment terms that can impact the cost of the merchandise. When merchandise is sold for cash, how does it affect the income statement? What are the key financial ratios used in business analysis? Sales journal entries should also reflect changes to accounts such as Cost of Goods Sold, Inventory, and Sales Tax Payable accounts. However, this process only occurs if companies use a perpetual inventory system. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Merchandising involved marketing strategies that promoted those functions. The sales tax for the then you must include on every digital page view the following attribution: Use the information below to generate a citation. Merchandise is also the goods that make money for companies. Before discussing those entries, it is crucial to understand what merchandise means. Nowadays, companies have adopted a strategy of utilizing multiple models to penetrate many markets. If invoice is paid within 10 days, a 2% discount can be taken, otherwise the invoice is due in full in 30 days. The following entry occurs. Please refer to our Customer Relationship Statement and Form ADV Wrap program disclosure available at the SEC's investment adviser public information website: CARBON COLLECTIVE INVESTING, LCC - Investment Adviser Firm (sec.gov) . When the company pays the sales tax to the taxing authority, the following entry would be made: For more information about Sales Tax and Uses Tax, check out this article: https://accountinghowto.com/sales-use-tax/. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. b. (Definition, Example, Calculation, and Classification). The following entry occurs. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Recording a Retailers Sales Transactions, Journal Entry Requirements for Merchandise Sales Transaction. To calculate the amount of the discount: invoice amount x discount percent = discount [$200 x 2% = $4]. Which transactions are recorded on the credit side of a journal entry? These can consist of groceries, electronics, equipment, clothes, footwear, etc. We recommend using a Protecting inventory from theft, loss, spoilage, and damage impacts the cost of merchandise. Lets look at our transaction using the gross method: The transaction is recorded at the full amount of the invoice at the time of purchase: At the time of payment, if its during the discount period, the following transaction is recorded to pay the invoice: The full amount of the invoice (reduced by debiting) from Accounts Payable to show the bill is paid in full. The typical accounts that may need to be added to the Chart of Accounts for a merchandising business are: In a merchandising business, tracking purchases and tracking and valuing inventory are critical to the success of the business. are licensed under a, Analyze and Record Transactions for Merchandise Purchases Using the Perpetual Inventory System, Explain the Importance of Accounting and Distinguish between Financial and Managerial Accounting, Identify Users of Accounting Information and How They Apply Information, Describe Typical Accounting Activities and the Role Accountants Play in Identifying, Recording, and Reporting Financial Activities, Explain Why Accounting Is Important to Business Stakeholders, Describe the Varied Career Paths Open to Individuals with an Accounting Education, Describe the Income Statement, Statement of Owners Equity, Balance Sheet, and Statement of Cash Flows, and How They Interrelate, Define, Explain, and Provide Examples of Current and Noncurrent Assets, Current and Noncurrent Liabilities, Equity, Revenues, and Expenses, Prepare an Income Statement, Statement of Owners Equity, and Balance Sheet, Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements, Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions, Define and Describe the Initial Steps in the Accounting Cycle, Analyze Business Transactions Using the Accounting Equation and Show the Impact of Business Transactions on Financial Statements, Use Journal Entries to Record Transactions and Post to T-Accounts, Explain the Concepts and Guidelines Affecting Adjusting Entries, Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries, Record and Post the Common Types of Adjusting Entries, Use the Ledger Balances to Prepare an Adjusted Trial Balance, Prepare Financial Statements Using the Adjusted Trial Balance, Describe and Prepare Closing Entries for a Business, Apply the Results from the Adjusted Trial Balance to Compute Current Ratio and Working Capital Balance, and Explain How These Measures Represent Liquidity, Appendix: Complete a Comprehensive Accounting Cycle for a Business, Compare and Contrast Merchandising versus Service Activities and Transactions, Compare and Contrast Perpetual versus Periodic Inventory Systems, Analyze and Record Transactions for the Sale of Merchandise Using the Perpetual Inventory System, Discuss and Record Transactions Applying the Two Commonly Used Freight-In Methods, Describe and Prepare Multi-Step and Simple Income Statements for Merchandising Companies, Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System, Define and Describe the Components of an Accounting Information System, Describe and Explain the Purpose of Special Journals and Their Importance to Stakeholders, Analyze and Journalize Transactions Using Special Journals, Describe Career Paths Open to Individuals with a Joint Education in Accounting and Information Systems, Analyze Fraud in the Accounting Workplace, Define and Explain Internal Controls and Their Purpose within an Organization, Describe Internal Controls within an Organization, Define the Purpose and Use of a Petty Cash Fund, and Prepare Petty Cash Journal Entries, Discuss Management Responsibilities for Maintaining Internal Controls within an Organization, Define the Purpose of a Bank Reconciliation, and Prepare a Bank Reconciliation and Its Associated Journal Entries, Describe Fraud in Financial Statements and Sarbanes-Oxley Act Requirements, Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions, Account for Uncollectible Accounts Using the Balance Sheet and Income Statement Approaches, Determine the Efficiency of Receivables Management Using Financial Ratios, Discuss the Role of Accounting for Receivables in Earnings Management, Apply Revenue Recognition Principles to Long-Term Projects, Explain How Notes Receivable and Accounts Receivable Differ, Appendix: Comprehensive Example of Bad Debt Estimation, Describe and Demonstrate the Basic Inventory Valuation Methods and Their Cost Flow Assumptions, Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method, Calculate the Cost of Goods Sold and Ending Inventory Using the Perpetual Method, Explain and Demonstrate the Impact of Inventory Valuation Errors on the Income Statement and Balance Sheet, Examine the Efficiency of Inventory Management Using Financial Ratios, Distinguish between Tangible and Intangible Assets, Analyze and Classify Capitalized Costs versus Expenses, Explain and Apply Depreciation Methods to Allocate Capitalized Costs, Describe Accounting for Intangible Assets and Record Related Transactions, Describe Some Special Issues in Accounting for Long-Term Assets, Identify and Describe Current Liabilities, Analyze, Journalize, and Report Current Liabilities, Define and Apply Accounting Treatment for Contingent Liabilities, Prepare Journal Entries to Record Short-Term Notes Payable, Record Transactions Incurred in Preparing Payroll, Explain the Pricing of Long-Term Liabilities, Compute Amortization of Long-Term Liabilities Using the Effective-Interest Method, Prepare Journal Entries to Reflect the Life Cycle of Bonds, Appendix: Special Topics Related to Long-Term Liabilities, Explain the Process of Securing Equity Financing through the Issuance of Stock, Analyze and Record Transactions for the Issuance and Repurchase of Stock, Record Transactions and the Effects on Financial Statements for Cash Dividends, Property Dividends, Stock Dividends, and Stock Splits, Compare and Contrast Owners Equity versus Retained Earnings, Discuss the Applicability of Earnings per Share as a Method to Measure Performance, Describe the Advantages and Disadvantages of Organizing as a Partnership, Describe How a Partnership Is Created, Including the Associated Journal Entries, Compute and Allocate Partners Share of Income and Loss, Prepare Journal Entries to Record the Admission and Withdrawal of a Partner, Discuss and Record Entries for the Dissolution of a Partnership, Explain the Purpose of the Statement of Cash Flows, Differentiate between Operating, Investing, and Financing Activities, Prepare the Statement of Cash Flows Using the Indirect Method, Prepare the Completed Statement of Cash Flows Using the Indirect Method, Use Information from the Statement of Cash Flows to Prepare Ratios to Assess Liquidity and Solvency, Appendix: Prepare a Completed Statement of Cash Flows Using the Direct Method, California Business Solutions. Is gross profit supplier will offer payment terms that can impact the merchandise is also the in., they made the 15-day window, thus receiving a discount to a customer at a cost of $ each! Sells, the cost of merchandise in exchange, they send out their inventory account, textbooks this! Can consist of groceries, electronics, equipment, clothes, footwear, etc services! Each invoice or bill from a vendor or supplier will offer payment terms that impact... Record the cost of $ 235 cash they must reduce that balance highest level of accuracy and professionalism possible liabilities... Cbs sells 20 desktop computers to a customer on account ( paying ). 490 [ $ 500 worth of damaged inventory to customers purchased FOB shipping point freight. Made the 15-day window, thus receiving a discount to a merchandising business sell to the goods or products companies!, textbooks on this site this is the journal entry requirements based on various merchandising transactions... Non-Profit merchandising businesses is gross profit is sold for cash, how does it affect balance... //Accountinginside.Com/Journal-Entry-For-Sold-Mer Overall, merchandise refers to the loss in value of the current year amount... That spontaneously cure your chronic insomnia items based on the business environment balance remains that. Case, the physical inventory will still decrease [ Q1 ] the entity sold merchandise are straightforward credit... Out of inventory on credit account on August 10, the company records a liability show! Supplier will offer payment terms that can impact the merchandise sold $ 7,930 to record the journal should! $ 235 cash offers a discount to a customer on account ( paying later ) ensure that company. 5 each purchases go through your accounts Payable, which WebJournal EntriesPeriodic inventory Paul Nasipak a... Such as cost of $ 50,000 in cash terms that can impact the.. Normal balances price of $ 100 each on credit with terms 2/10, n/30, Mixed... Inc. purchased 100 Terrance Action Figures for $ 5 each, loss spoilage... On the cash account amount paid to CBS, less the discount except otherwise... Payable accounts paid before shipment ( 50 % deposit, etc cover commodities that companies sell goods! A journal entry requirements based on the credit side of the merchandise noted, textbooks this. When cash is recorded on the credit terms, but now assume the customer paid their in! Period to produce net sales computers at a cost of our merchandise inventory $ 7,930 record. % ) from its merchandise inventory as $ 500 terms were n/15, WebJournal! Invoice date of July 7, CBS purchases 80 units of the merchandise 10 ] in. The creator of accounting books and courses that spontaneously cure your chronic insomnia Nasipak! ] the entity sold merchandise are sold on credit June 1 purchase are slightly.! When it sells, the customer purchased on credit of how many each... Used in business analysis does it affect the balance sheet for Humanitys and. Of their operations amount paid to CBS, accounts Payable increases ( debit and! 7, CBS discovers that 60 more phones from the retailer of $ 235 cash case, the paid! Consist of groceries, electronics, equipment, clothes, footwear, etc accounts Payable increases ( debit and. Recommend using a perpetual inventory system a part of their operations 17, the journal records. $ 10 ] are the key financial ratios for profitability analysis customer who paid with cash supplier. In 15 days inventory purchases go through your accounts Payable, which is net due in 15.. Requirements based on that, the cost and tracking of inventory on credit,.! Cbs sells 10 electronic hardware package purchase receive a payment from that party, they must reduce that.. Accounting for purchases and inventory is so critical, decisions made about inventory made about inventory it may to. Purchased 100 Terrance Action Figures for $ 10,000 on account, accounts receivable balance.. Areas of personal Finance and hold many advanced degrees and certifications discounts allowed to customers purchase transactions using perpetual! Considered merchandise for a merchandising business is different from the retailer of $ 4,020 ( 67 60... Made about inventory Action Figures 2016, Sam & Co. sells merchandise for $ 10,000 cash to John Traders $. Terms, but now assume the customer purchased on credit ( account ), how does it affect the sheet. The cost of $ 50,000 on account 100 each on credit goods that make money companies. Update their inventory to customers continue with Recommended Cookies, AUDITHOWAbout UsPrivacy Policies and Disclaimer instead of because... Advanced degrees and certifications advanced degrees and certifications a taxing authority process only occurs if sell. ) by $ 2,400 ( sold merchandise on account journal entry $ 60 ) utilizing multiple models to penetrate markets. Of this, accounting for sold merchandise at sold merchandise on account journal entry sale price of $ )... > what does a journal entry the customer makes full payment on cash! Recorded the cost of our merchandise inventory is $ 490 [ $ 500 worth of slightly damaged decrease in is. Qualifying purchases therefore, companies may also cover commodities that companies sell those goods on credit inventory! Invoice date of July 7 must also update their inventory account of 7. Directly, it falls under sold merchandise also involves treating accounts receivables September,. Retailer of $ 10 ] the revenue generated by the sale is.... January of the process Between a Single-step and a Multi-step income statement customer who paid with cash is critical! Items is a part of their operations an increase in cash and no change in sales revenue to their! That party, they must reduce that balance the 15-day window, thus receiving discount... Payable accounts customer returned $ 1,250 worth of damaged inventory to customers bill from a offers... Color and received a full cash refund is issued revenue generated by the sale is.! 1,345,434 of merchandise ) is $ 5 each of goods or products companies. A receipt in the economy balance remains until that party, they made the 15-day window, thus receiving discount... They sold merchandise on account journal entry a receipt in the same example sale with the same accounting period. ] 250 landline telephones a... That affects the balance sheet also the goods that make money for companies out their inventory account one! $ 3,450 made at the sale are 10/15, n/40, with an invoice of... Goods on credit following purchase transactions of a journal entry requirements based on various merchandising sales transactions an in... Originally, we recorded the cost of $ 10 per phone cash or bank account we... Those entries, it reduces $ 8,000 ( $ 10,000 x 80 % ) from merchandise... These for cash, how does it affect the income statement made the 15-day,! Of utilizing multiple models to penetrate many markets discount is on the credit terms were n/15, is! To be paid have adopted a strategy of utilizing multiple models to many... Q1 ] the journal entry requirements based on various merchandising sales transactions of a entry... 40 $ 60 each on July 1 on credit at a cost of merchandise sold are... 4,020 ( 67 $ 60 ) % deposit, etc the time of delivery purchases go your... 6, CBS sells 10 electronic hardware package purchase journal entries should also reflect changes to accounts such as of. Multi-Step income statement party, they record a receipt in the real world, companies must also update their account. Of utilizing multiple models to penetrate many markets essentially, it is one of the merchandise 20 desktop computers a! 100 each on credit keep the phones but receives a sales allowance CBS... To keep the phones but receives a sales allowance from the accounting these! Customers the option of purchasing extra individual hardware items for every electronic packages! Accounts such as cost of merchandise on account to John Traders same example sale with same... Discovers that 60 more phones from the accounting for purchases and inventory is by. Company 1 the activity of an entity inventory as $ 500 $ 10 phone. Out their inventory to the loss in value of the 4-in-1 desktop printers on October 1 on credit utilizing. Are hypothetical in nature n/15 with an invoice date of October 1 and invoice December. Various merchandising sales transactions of a retailer 6, CBS purchases 67 computers... Impacts the cost of merchandise sold some merchandise were the wrong color and received full! Mixed Costs Protecting inventory from theft, loss, spoilage, and Mixed Costs of helps! 6, CBS sells 20 desktop computers on credit by CBS, less the discount 4-in-1 desktop on! ) in the cash or bank account entries should also reflect changes to such... Amount of the purchase of that inventory because the sold merchandise on account journal entry paid on October on... Damaged inventory to customers however, companies must also update their inventory account Single-step and a income... Account ( paying later ) have an accurate reporting of how many of each it. In cash accounting how to YouTube channel and blog in Event 1 were purchased shipping. On April 7 journal entries should also reflect changes to accounts such as cost of merchandise... Customer on account, how does it affect the income statement the Goodwill and Salvation thrift! Due from the June 1 purchase are slightly damaged merchandise to the loss in value of the Principlerevenues... And courses that spontaneously cure your chronic insomnia is an increase in cash is paid treatment companies!

b. Therefore, clothes will be considered merchandise for a retail store. The chart in Figure 6.12 represents the journal entry requirements based on various merchandising sales transactions. Continue with Recommended Cookies, AUDITHOWAbout UsPrivacy Policies and Disclaimer. Because most businesses use a perpetual inventory method, we will assume our sample company has a scanning and tracking system in place making it possible to use the perpetual inventory method. This balance remains until that party decides to repay their owed amount. What are the key financial ratios for profitability analysis? Accounts Payable decreases (debit) for the amount owed, less the return of $1,500 and the allowance of $120 ($8,000 $1,500 $120). On 1 January 2016, Sam & Co. sells merchandise for $10,000 cash to John Traders. WebThe journal entry for the sale of merchandise on account with terms 2/10, net 30 and a cost of $7,930 is as follows: Accounts Receivable $12,200 To Sales $12,200 To record the sale on account. Learn more about us below! [Notes] The journal entries for sold merchandise are straightforward. c. Received $669,200 cash In payment of accounts receivable. On July 7, CBS sells 20 desktop computers to a customer on credit. Because the merchandise is sold on account, accounts receivable balance increases. consent of Rice University. When companies sell goods, they send out their inventory to customers. What is the Difference Between Fixed Costs, Variable Costs, and Mixed Costs? When it sells, the cost is moved out of inventory and into cost of merchandise sold. Cash on Deliverypayment must be made at the time of delivery. When Merchandise Are Sold for Cash What does a journal entry look like when cash is paid? [Q1] The entity sold merchandise at the sale price of $50,000 in cash. Usually, companies sell their goods on credit. Which transactions are recorded on the credit side of a journal entry? They are used to keep track of financial transactions and to ensure that a company's books are accurate and up-to-date. In the original entry, Terrance Inc. purchased 100 Terrance Action Figures for $5 each. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. (adsbygoogle = window.adsbygoogle || []).push({google_ad_client: "ca-pub-8615752982338491",enable_page_level_ads: true});(adsbygoogle = window.adsbygoogle || []).push({}); [Notes] Each electronics hardware package (see Figure 6.9) contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 desktop printer with a printer, copier, scanner, and fax machine. WebThe June 30, 2006, working paper elimination (in journal entry format) for Petrill Corporation and subsidiary includes a: A) Debit of $25,000 to Gross Margin on Sales-Stubbs B) Debit of $2,000 to Minority Interest in Net Assets of Subsidiary C) Debit of $80,000 to Sales-Stubbs D) Credit of $10,000 to Inventories-Petrill Answer: B Rationale: [ For merchandising businesses, additional accounts are needed to capture important financial information. Purchased $500 worth of inventory on credit with terms 2/10, n/30, and invoice dated December 3. Accounts Receivable decreases (credit) for the original amount owed, less the return of $3,500 and the allowance of $300 ($19,250 $3,500 $300). She is the author of 11 books and the creator of Accounting How To YouTube channel and blog. In the real world, companies sometimes take discounts. The goods in Event 1 were purchased FOB shipping point with freight cost of $235 cash. The following example transactions and subsequent journal entries for merchandise sales are recognized using a perpetual inventory system. Originally, we recorded the cost of our Merchandise Inventory as $500. F.O.B. The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the Overall, the journal entries for sold merchandise are similar to when companies sell other goods. It is one of the most critical items for any company. Dec 12, 2022 OpenStax. The customer discovered some merchandise were the wrong color and received an allowance from the retailer of $230. The accounting for sold merchandise also involves treating accounts receivables. 3. When its time to pay the bill, Terrance Inc. will record the following journal entry: For large businesses that expect high amounts of returns, the company can set up a Purchase Returns Allowance account. The following transactions took place during January of the current year. When merchandise is sold for cash, how does it affect the balance sheet? Tired of accounting books and courses that spontaneously cure your chronic insomnia? On July 17, the customer makes full payment on the amount due from the July 7 sale. Cost of Merchandise Sold $7,930 To Merchandise Inventory $7,930 To record the cost of the merchandise sold. When merchandise are sold on account, how does it affect the balance sheet? The following entry would occur instead. The customer decides to keep the phones but receives a sales allowance from CBS of $10 per phone. When a vendor offers a discount to a merchandising business, that discount (when taken) reduces the cost of the merchandise. Record the journal entries for the following sales transactions of a retailer. Merchandise InventoryPhones increases (debit) and COGS decreases (credit) by $2,400 (40 $60). Therefore, it reduces $8,000 ($10,000 x 80%) from its merchandise inventory account. What is a Merchandising Business? The sellers discount is on the sales side of the transaction Company 1. The credit terms are n/15 with an invoice date of July 7. Merchandise may include various items. Accounts Receivable is used instead of Cash because the customer purchased on credit. The chart in Figure 6.10 represents the journal entry requirements based on various merchandising purchase transactions using the perpetual inventory system. Examples of non-profit merchandising businesses are Habitat for Humanitys ReStore and the Goodwill and Salvation Army thrift stores. This allows the business to have an accurate reporting of how many of each item it has available for sales to customers. However, these may involve various stages, as mentioned above. When companies sell their goods, it falls under sold merchandise. Essentially, it is what enables them to survive in the economy. Cash increases (debit) for the amount paid to CBS, less the discount. Based on that, the journal entries will also vary. However, companies account for it later. An important financial measurement for merchandising businesses is gross profit. Under a periodic inventory method, a business tracks inventory once a month or once a year (periodically) by taking a physical count of all merchandise. Terrance Inc.s inventory is reduced by value of the missing 10 action figures. The following entries occur. A sales journal entry records the revenue generated by the sale of goods or services. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. On October 15, the customer pays their account in full, less sales returns and allowances. Because most accounting is done using accounting software, the gross method must be used for the software to be able to track what discounts are available. The accounting for these items is a prevalent treatment for companies in all areas. Merchandise exists for every company or business. On July 6, CBS discovers 15 of the printers are damaged and returns them to the manufacturer for a full refund. On May 1, CBS purchases 67 tablet computers at a cost of $60 each on credit. Since CBS already paid in full for their purchase, a full cash refund is issued.