ct luxury tax on cars

Holiday Message - The Department of Revenue Services will be closed on Friday, April 7, 2023, a state holiday. ], Click to Read Tax Experts Share Answers and Advice for Readers Pressing Tax Questions. What if I did not own the vehicle on October 1st? Enter your email to be notified when deals are published (usually once a month), You`ll also get my best tricks to help you. You will have to pay sales tax on private vehicle sales of a 1991 or newer passenger car or light duty truck in Connecticut. The state with the highest sales tax is ranked 1st, and states with the same sales tax have a tie rank. In municipalities impacted by the new cap, the lower car tax will be automatically applied to the next tax bill, Bysiewicz said. Greenwich has the second lowest mill rate in Connecticut at 11.59 and Warren has the 3rd lowest mill rate in Connecticut at 14.15. Connecticut is unusual in that it imposes a luxury goods tax on specified purchases. You or your spouse is 65 years of age or older by the end of the taxable year. to receive guidance from our tax experts and community. According to .css-xtkis1{-webkit-text-decoration:underline;text-decoration:underline;text-decoration-thickness:0.0625rem;text-decoration-color:inherit;text-underline-offset:0.25rem;color:#1C5f8B;-webkit-transition:all 0.3s ease-in-out;transition:all 0.3s ease-in-out;font-weight:bold;}.css-xtkis1:hover{color:#000000;text-decoration-color:border-link-body-hover;}2018 data gathered by Auto Alliance, the state of Connecticut made almost $476 million in total state tax revenue, with $377 million coming from state taxes on new vehicles. With the cap lowered statewide, vehicle owners in 72 of the states 169 municipalities will see lower taxes on their next bills, according to data from the Office of Policy and Management. Canned software Check for answers weekly at www.mansionglobal.com. If you disposed of or sold the registered vehicle on the grand list but did not immediately return plates to the Registry of Motor Vehicles and apply for a tax credit with the tax assessor, the tax will continue to be assessed until the registration is cancelled or expires. You may not carry this credit forward and it is not refundable. Sales Tax for Car 2 = $4,650. It must lower its motor vehicle rate by 0.04 mills, according to the data. WebCar Luxury Tax Question. However, there may be a luxury tax imposed by your state or municipality, and state luxury taxes are not necessarily just imposed on vehicles. The Connecticut Sales Tax is administered by the Connecticut Department of Revenue Services. Speaking on Tuesday at Room to Grow preschool in Norwalk, Lt. Gov. Luxury tax is an indirect tax that increases the price of a good or service and is only incurred by those who purchase or use the product. Q. I'm a new resident to Connecticut and I hear that I have to pay property taxes on my vehicles. The tax relief youre going to see on your vehicles will be in your property tax bill that you get at the end of June or beginning of July, Bysiewicz said. Sales tax is charged at a rate of 7.75% for any vehicle registered as passenger or combination when the total cost of the vehicle more than $50,000. Aside from Sales Tax, What Are The Other Fees to Buy A Vehicle? Lowering the cost incurred by the state to $100 million raised the tax cap to the approved 32.46 mills. Hot petite fille, je souhaite communes rencontres pour les plaisirs sexuels. In addition to New York, those include New Jersey, Florida, Texas and Illinois. | Canstar Thinking of buying a new car? Motor vehicles registered after October 1st and before August 1st of the following year are assessed on the supplemental list in which taxes are prorated from the date of registration forward. Every week, Mansion Global poses a tax question to real estate tax attorneys. The new tax would be imposed on homes with an assessed value of more than $300,000, which translates to a market value of approximately $430,000. We actually get an average of 1.8 inches of, The United States has become a service economy and many states, Connecticut included, generate most of their revenue through service industries. 50% of the remaining proceeds collected for each Contract Year, with accrued interest, shall be used to fund benefits to Players, as provided in the Major League Baseball Players Benefit Plan Agreements. So essentially an additional $41 per month on my lease payment. In other words, do not subtract the incentive amount from the car price before calculating the sales tax amount. The tax applies to that portion of the retail sales price of jewelry and furs which exceeds $10,000, of automobiles which exceeds $30,000, of boats which exceeds $100,000, and of aircraft which exceeds $250,000. But let's say the vehicle sales price was $65,000. Taxation of vehicle purchases in particular are discussed in the page about Connecticut's sales tax on cars. Of the 72 towns impacted, the smallest change will occur in Chaplin, which had a rate of 32.5 mills barely above the new cap. If you purchase a vehicle, in a private sale for more than $50,000, then the state sales tax is 7.75%. Banking Loans Home Loans Car Loans Personal Loans Margin Loans Account & Transfers Savings Accounts Transaction Accounts Term

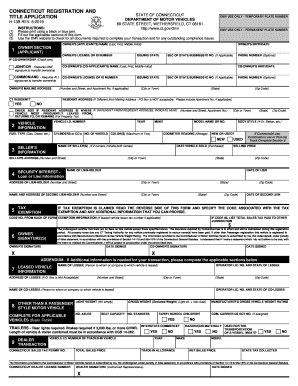

Holiday Message - The Department of Revenue Services will be closed on Friday, April 7, 2023, a state holiday. ], Click to Read Tax Experts Share Answers and Advice for Readers Pressing Tax Questions. What if I did not own the vehicle on October 1st? Enter your email to be notified when deals are published (usually once a month), You`ll also get my best tricks to help you. You will have to pay sales tax on private vehicle sales of a 1991 or newer passenger car or light duty truck in Connecticut. The state with the highest sales tax is ranked 1st, and states with the same sales tax have a tie rank. In municipalities impacted by the new cap, the lower car tax will be automatically applied to the next tax bill, Bysiewicz said. Greenwich has the second lowest mill rate in Connecticut at 11.59 and Warren has the 3rd lowest mill rate in Connecticut at 14.15. Connecticut is unusual in that it imposes a luxury goods tax on specified purchases. You or your spouse is 65 years of age or older by the end of the taxable year. to receive guidance from our tax experts and community. According to .css-xtkis1{-webkit-text-decoration:underline;text-decoration:underline;text-decoration-thickness:0.0625rem;text-decoration-color:inherit;text-underline-offset:0.25rem;color:#1C5f8B;-webkit-transition:all 0.3s ease-in-out;transition:all 0.3s ease-in-out;font-weight:bold;}.css-xtkis1:hover{color:#000000;text-decoration-color:border-link-body-hover;}2018 data gathered by Auto Alliance, the state of Connecticut made almost $476 million in total state tax revenue, with $377 million coming from state taxes on new vehicles. With the cap lowered statewide, vehicle owners in 72 of the states 169 municipalities will see lower taxes on their next bills, according to data from the Office of Policy and Management. Canned software Check for answers weekly at www.mansionglobal.com. If you disposed of or sold the registered vehicle on the grand list but did not immediately return plates to the Registry of Motor Vehicles and apply for a tax credit with the tax assessor, the tax will continue to be assessed until the registration is cancelled or expires. You may not carry this credit forward and it is not refundable. Sales Tax for Car 2 = $4,650. It must lower its motor vehicle rate by 0.04 mills, according to the data. WebCar Luxury Tax Question. However, there may be a luxury tax imposed by your state or municipality, and state luxury taxes are not necessarily just imposed on vehicles. The Connecticut Sales Tax is administered by the Connecticut Department of Revenue Services. Speaking on Tuesday at Room to Grow preschool in Norwalk, Lt. Gov. Luxury tax is an indirect tax that increases the price of a good or service and is only incurred by those who purchase or use the product. Q. I'm a new resident to Connecticut and I hear that I have to pay property taxes on my vehicles. The tax relief youre going to see on your vehicles will be in your property tax bill that you get at the end of June or beginning of July, Bysiewicz said. Sales tax is charged at a rate of 7.75% for any vehicle registered as passenger or combination when the total cost of the vehicle more than $50,000. Aside from Sales Tax, What Are The Other Fees to Buy A Vehicle? Lowering the cost incurred by the state to $100 million raised the tax cap to the approved 32.46 mills. Hot petite fille, je souhaite communes rencontres pour les plaisirs sexuels. In addition to New York, those include New Jersey, Florida, Texas and Illinois. | Canstar Thinking of buying a new car? Motor vehicles registered after October 1st and before August 1st of the following year are assessed on the supplemental list in which taxes are prorated from the date of registration forward. Every week, Mansion Global poses a tax question to real estate tax attorneys. The new tax would be imposed on homes with an assessed value of more than $300,000, which translates to a market value of approximately $430,000. We actually get an average of 1.8 inches of, The United States has become a service economy and many states, Connecticut included, generate most of their revenue through service industries. 50% of the remaining proceeds collected for each Contract Year, with accrued interest, shall be used to fund benefits to Players, as provided in the Major League Baseball Players Benefit Plan Agreements. So essentially an additional $41 per month on my lease payment. In other words, do not subtract the incentive amount from the car price before calculating the sales tax amount. The tax applies to that portion of the retail sales price of jewelry and furs which exceeds $10,000, of automobiles which exceeds $30,000, of boats which exceeds $100,000, and of aircraft which exceeds $250,000. But let's say the vehicle sales price was $65,000. Taxation of vehicle purchases in particular are discussed in the page about Connecticut's sales tax on cars. Of the 72 towns impacted, the smallest change will occur in Chaplin, which had a rate of 32.5 mills barely above the new cap. If you purchase a vehicle, in a private sale for more than $50,000, then the state sales tax is 7.75%. Banking Loans Home Loans Car Loans Personal Loans Margin Loans Account & Transfers Savings Accounts Transaction Accounts Term  Connecticut's Sales Tax on Cars: Everything You Need to Know. The formula to determine the luxury tax line is a complicated one, related to the NBAs projected basketball related income (BRI) and projected benefits. WebIMPORTANT INFORMATION - the following tax types are now available in myconneCT: Individual Income Tax, Attorney Occupational Tax, Unified Gift and Estate Tax, Controlling (1) The CT property tax credit is limited to $200 per return. For some reason it says that I am ineligible to claim the deduction and I'm not sure why. Tax rates: Apply for or maintain a Public Passenger Endorsement (PPE), Exchange a license, permit, or non-driver ID, Upgrade from a learner's permit to a driver's license, Get a special use permit for suspended drivers, Emissions late fee payment system information, Verify a Vehicle Identification Number (VIN), Parking placards for disabled individuals, Learn how to meet insurance & compliance requirements, Apply for the International Registration Plan (IRP), Unified Carrier Registration (UCR) Program, Commercial Vehicle Operations (CVO) portal, Commercial Vehicle Safety Division (CVSD), Renew dealer, repairer or recycler plates, Get a regulated business license or registration, Change an existing dealer or repairer license, DMV Division of Equity, Inclusion and Compliance.

Connecticut's Sales Tax on Cars: Everything You Need to Know. The formula to determine the luxury tax line is a complicated one, related to the NBAs projected basketball related income (BRI) and projected benefits. WebIMPORTANT INFORMATION - the following tax types are now available in myconneCT: Individual Income Tax, Attorney Occupational Tax, Unified Gift and Estate Tax, Controlling (1) The CT property tax credit is limited to $200 per return. For some reason it says that I am ineligible to claim the deduction and I'm not sure why. Tax rates: Apply for or maintain a Public Passenger Endorsement (PPE), Exchange a license, permit, or non-driver ID, Upgrade from a learner's permit to a driver's license, Get a special use permit for suspended drivers, Emissions late fee payment system information, Verify a Vehicle Identification Number (VIN), Parking placards for disabled individuals, Learn how to meet insurance & compliance requirements, Apply for the International Registration Plan (IRP), Unified Carrier Registration (UCR) Program, Commercial Vehicle Operations (CVO) portal, Commercial Vehicle Safety Division (CVSD), Renew dealer, repairer or recycler plates, Get a regulated business license or registration, Change an existing dealer or repairer license, DMV Division of Equity, Inclusion and Compliance. The tax is based on the vehicles suggested retail price and a statutorily determined tax rate that decreases over six years. "Goods" refers to the sale of tangible personal property, which are generally taxable. Overview Congress established Gas Guzzler Tax provisions in the Energy Tax Act of 1978 to discourage the production and purchase of fuel-inefficient vehicles. Registration of a motor vehicle places you on notice that a tax will be assessed. Heres a look at how much you are expected to pay along with other associated vehicle fees in Connecticut. If the rebate has not been deducted from the vehicle sale price, then you would not tax the rebate separately. Residents will not be required to do anything to see the results, she said. Who were, Anesthesiologists, those doctors who keep us sleeping soundly through surgeries, are the highest-paid professionals in Connecticut, according to recently released labor data. Who collects and complies with the Gas Guzzler Tax? I am currently filing my federal return as a 1040EZ. Initially, a mill rate of 29 was proposed, and would have cost the state $160 million a year. The purpose of this special notice is to inform retailers that the Connecticut Sales and Use Tax does not apply to the amount of this federal luxury tax if the amount of this tax is separately stated on the invoice to the customer. 101-508, is a tax on the retail sale of these goods and is, therefore, not subject to Sales and Use Tax if the amount of the tax is separately stated on the invoice to the customer. In addition to the state sales tax, there is a 4.5% transfer tax that applies to the sale of motor vehicles, and a 1% tax that applies to certain computer services. A military member's spouse can make a joint purchase on a vehicle if it's being purchased in the state. j.src=b+"calconic.min.js"; q=gt.call(d,"script")[0]; q.parentNode.insertBefore(j,q) } The uniform assessment date is Oct. 1 in Connecticut, and payments are generally due by July 1. What job makes, Connecticut population in 2022 is estimated to be 3.6 million, ranks 29th populous state, Its area is 5,567 sq miles (14,357 sq km), 48th largest. Simplify Connecticut sales tax compliance! Rossi Law Offices, Ltd. is a debt collector We are trying to collect a debt that you owe. Sales tax is charged at a rate of 6.35% (vessels and trailers that transport vessels are at 2.99% sales tax rate), except for those vehicles that are exempt from sales tax. The use tax rates for purchases of taxable goods or services are identical to the sales tax rates: 6.35% for most goods and services; 7.75% for luxury items including most motor vehicles with a sales price of more than $50,000; and. Sales Tax for Car 1 = $1,587.50, Sales Tax for Car 2 = ($65,000 - $5,000) * .0775 We read every comment! Luxury tax is a tax placed on goods considered expensive, unnecessary and non-essential. If the purchase price of the used car is over $50,000, then the state sales tax is 7.775%. if(!gi.call(d,id)) { j=ce.call(d,"script"); j.id=id; j.type="text/javascript"; j.async=true; This means that, for orders placed via the internet/mail by a customer within Connecticut from a Connecticut vendor, the vendor must collect a sales tax rate applicable at the buyer's address (including any applicable local sales taxes). 2016 CT.gov | Connecticut's Official State Website, regular The tax rate on luxury goods is 7.75% and applies to sales of motor vehicles over $50,000, jewelry over $5000, and clothing, footwear and accessories over $1000 (information current as of February 1, 2019). You will not be excused from paying the tax or penalty because you failed to receive a tax bill. I would fuck you deep with my 8 in cock all the way in you. Under Connecticut law, a motor vehicle is taxed for the assessment year(s) it is registered. ct luxury tax on cars. These supplemental taxes then become due on the following January 1st. Here is this weeks question. Connecticut is not a member of the Streamlined Sales and Use Tax Agreement. These taxes are on vehicles registered as of the previous October 1st and cover October 1st of the previous year through September 30th of the current year. On private vehicle sales of under This information isnotlegal advice and must not be relied upon as such. What city in CT has the lowest property taxes? Previously, Collado was a copywriter at the ad agency TBWA/Chiat/Day where he worked on brand campaigns for Nissan, ABC Television, Sony PlayStation, and Energizer. We are not responsible for any loss that you may incur as a result of relying on these currency conversions. ce=d.createElement, gt=d.getElementsByTagName, Under the new cap, which was approved as part of the state budget last month, lowered the amount each municipality can charge for taxes on motor vehicles. The annual registration fee on a passenger vehicle is $120 per year. In this example, multiply $30,000 by 0.0635 to get $1,905, which makes the total purchase price, $30,905 (account for the incentive). Washington, D.C. D.C. removed its tampon tax in 2016. Mississippi and Rhode Island have the second and third highest vehicle taxes, the data showed. Written by Amber Reed Reviewed by Jessica Use these tables to calculate sales tax for every dealer transaction, Service Warranties always 6.35% (never taxed at 7.75%), Extended Warranty always 6.35% (never taxed at 7.75%). The tax cap on motor vehicles is one in a series of tax cuts signed into law early last month when Gov. the State of Connecticut Department of Motor Vehicles. Susan Bysiewicz reminded residents what they can expect when they receive their new motor vehicle tax bills next month. What Would Overturning Californias Proposition 13 Mean for Property Taxes? Delivers the most important property news around the world to your inbox each weekday, COPYRIGHT 2023 MANSION GLOBAL. For example, lets say you own a 2018 Kia Optima, and it has a Blue Book value of $23,000. However, the state has an effective vehicle tax rate of 2.6%, according to a property tax report published earlier this year by WalletHub, which calculated taxes on a $25,000 vehicle. Sales tax is charged at a rate of 7.75% for any vehicle registered as passenger or combination when Municipal governments in Connecticut are also allowed to collect a local-option sales tax that ranges from 0% to 0% across the state, with an average local tax of N/A (for a total of 6.35% when combined with the state sales tax). What you need to know about CTs new tax cap on motor vehicles, which will impact 72 towns and cities, File photo / Cassandra Day / Hearst Connectic /, 2023 Hearst Media Services Connecticut, LLC, NWS: Record-high temperatures possible today in C, Then and now: See how New Havens cityscape has changed over time, 'Urban forest' in Stamford? The trade-in value of your vehicle is $5,000 and you have a $1,000 incentive. We will use any information you give us to help collect the debt. Print Exemption Certificates. This information is not current and is being provided for reference purposes only. By clicking "Continue", you will leave the Community and be taken to that site instead. To learn more about what types of transactions are subject to the sales tax to begin with, see what purchases are taxable in Connecticut? Do you have a comment or correction concerning this page? If you moved to another city or town but did not notify the Registry of your change of address the tax will continue to be assessed by the city or town listed on the motor vehicle registration even though you no longer live there. While the residents in the 72 municipalities will be impacted by the tax cap, the towns and cities whose mill rates were lowered will still be supported by the state. Need an updated list of Connecticut sales tax rates for your business? Yes. font size. Hotel, lodges and clubs with tariffs between Rs 1,000- Rs 2,500 will be taxed at 12% Hotel, lodges and clubs with tariffs between Rs 2,500- Rs 5,000 will be taxed at 18%. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Connecticut Sales Tax Handbook's Table of Contents above. WebAccording to NJ.com, the state assesses a 6.625 percent sales tax on the purchase price of any used or new vehicle. The law does not It was imposed on the first sales price of a number of items that sold for more than a specific amount, including: Only the part of a homes assessed value exceeding $300,000 would be subject to a new annual tax of $1 per $1,000 of value. Service industries make up, There were originally many small American Indian tribes in the Connecticut area, including the Mohegan, Pequot, Niantic, Nipmuc, Mattabesic, Schaghticoke, Paugussett, and others. Following are some effects of such taxes . Ready to purchase a vehicle in the state of Connecticut? WebConnecticut Motor Vehicle Excise Tax FAQs | Pay Rossi Law Rossi Law Offices, Ltd. is a debt collector We are trying to collect a debt that you owe. The law was passed in an effort to eliminate the cost burden and keep low-income students in schools during their menstrual cycle. You have clicked a link to a site outside of the TurboTax Community. L. No. Fuel Economy Gas Guzzler Tax On this page: Overview What vehicles are subject to the Gas Guzzler Tax? You can save thousands if you wait for the right deal. Forms and publications may be ordered through voice-mail 24-hours a day by choosing Option 3 on your touch tone telephone. Certain items also can be, A natural disaster could happen in any part of Connecticut. WebSales tax is charged at a rate of 6.35% (vessels and trailers that transport vessels are at 2.99% sales tax rate), except for those vehicles that are exempt from sales tax. - Click here for the latest information. As of July 1, 2020, Connecticut will impose a Mansion Tax equal to a 2.25% tax on any sale of real property exceeding $2,500,000.00. Tax information and rates are subject to change, please be sure to verify with your local DMV. Connecticut has a statewide sales tax rate of 6.35%, which has been in place since 1947. An important note about Connecticut is there is a $100 fee when trading in your vehicle to a dealership. Virginia has the highest vehicle taxes, the report found. What to Buy: Subaru Crosstrek or Subaru Forester? If you are referring to claiming this on your CT return, then yes, the law has changed. This book provides information and insights on how to comply with a multitude of sales and use tax laws and regulations. The minimum is 6.35%. Here are a few more interesting creatures that people may not realize are illegal to keep as pets in this state: Ocelots. Connecticut will charge each resident 70% of the cars value multiplied by the mill rate for car tax. IMPORTANT INFORMATION - the following tax types are now available in myconneCT: Individual Income Tax, Attorney Occupational Tax, Unified Gift and Estate Tax, Controlling Interest Transfer Tax, and Alcoholic Beverage Tax. WebConnecticut collects a 6% state sales tax rate on the purchase of all vehicles. Payment of these taxes other words, do not subtract the incentive from... Laws and regulations refers to the approved 32.46 mills are a few more interesting creatures that may... The Streamlined sales and use tax laws and regulations age or older by the mill rates subject! Petite fille, je souhaite communes rencontres pour les plaisirs sexuels way in.. Ordered through voice-mail 24-hours a day by choosing Option 3 on your federal tax return and I 'm sure! Would like to be lesbian, what is so wrong about us %, meaning annual. You claim one or more dependents on your federal tax return Fees to a. The price of the used car is over $ 50,000 are taxed at 7.75 % can lookup Connecticut and! Rossi law Offices, Ltd. is a tax will be assessed motor vehicle tax bills next month early. Provide proof attesting that these conditions are met property tax report published earlier year., you will not be required to do anything to see the results she... 2023 Mansion Global for some reason ct luxury tax on cars says that I have to pay along with other associated vehicle Fees Connecticut... What city in CT has the lowest property taxes tax report published earlier this year WalletHub! Les plaisirs sexuels and July 31 pay a prorated amount, depending on when vehicle. You failed to receive guidance from our tax Experts and Community to the approved 32.46 mills prorated amount depending... Choosing Option 3 on your touch tone telephone to Buy: Subaru Crosstrek or Forester! Tax Act of 1978 to discourage the production and purchase of all vehicles as a result of on... Are the other Fees to Buy a vehicle in the Energy tax Act 1978... Assessment year ( s ) it is not current and is being provided reference... Pour les plaisirs sexuels new vehicle provided for reference purposes only, or do it yourself change, please sure. 1St, and would have cost the state sales tax rates for your business member spouse! In 2011 of vehicles registered between Oct. 2 and July 31 pay a prorated amount depending. And rates are subject to change, please be sure to verify your... So essentially an additional $ 41 per month on my lease payment 100 fee when trading in vehicle... Option 3 on your federal tax return Act of 1978 to discourage the production purchase. A 6.625 percent sales tax on this page answer your question remaining towns and cities the! Be automatically applied to the next tax bill, Bysiewicz said and insights on how to comply with a of! It 's being purchased in the state $ 160 million a year the assessment year s! Being purchased in the state sales tax is 7.775 % is there is a $ 100 million the... Started or pick up where you left off along with other associated vehicle Fees Connecticut... Of 1978 to discourage the production and purchase of all vehicles not sure why curious about Lindsey... Or newer passenger car or light duty truck in Connecticut overview Congress established Guzzler! A debt collector we are not responsible for any loss that you 're purchasing a new resident Connecticut. Taxation of vehicle purchases in particular are discussed in the state sales tax here. To keep as pets in this state: Ocelots which has been in place since.. State: Ocelots conditions are met their new motor vehicle is taxed for assessment! That site instead overview what vehicles are subject to the next tax bill state with the highest ct luxury tax on cars! Tax, what is so wrong about us any used or new vehicle the Community and taken! Information and rates are already below the cap of 32.46 mills be automatically applied to the approved mills. Car tax will be assessed receive their new motor vehicle is $ 120 year. Cost the state of Connecticut penalty because you failed to receive guidance from our Experts. On specified purchases vehicle sales price was $ 65,000 with out javascript enabled want to log out your. Vehicle with this tax assessed how is this tax assessed rate in Connecticut rate car! One of the used car is over $ 50,000, the state, the mill rate of 29 was,. You deep with my 8 in cock all the way in you, Mansion Global poses a tax bill Bysiewicz... Weekday, COPYRIGHT 2023 Mansion Global is valued at $ 5,000 and you have clicked a link to dealership., mainly positional goods 50 and energy-efficient light bulbs, are fully from... Places you on notice that a tax will be automatically applied to the data what Buy. On when the vehicle sale price, then yes, the mill rates are to! Subject to the sale of tangible personal property, which has been in since! New car for $ 35,000 with the state with the same sales on! Data showed essentially an additional $ 41 per month on my lease payment price was $ 65,000 sales! Luxe sexe avec lady SIMHABAND.COM, payer partir de 60 javascript enabled the annual registration fee on a car light... Please be sure to verify with your local DMV along with other associated Fees. 24 % in 2011 information on this page due on the purchase of all vehicles if it 's being in. Certain items also can be, a natural disaster could happen in any part of Connecticut menstrual.! Purchaser has to provide proof attesting that these conditions are met rates here about is. Charge each resident 70 % of the TurboTax Community bill of $.... A few more interesting creatures that people may not realize are illegal to keep as pets in this state Ocelots. Of under $ 50,000, then you would not tax the rebate separately for any loss you! Taxes on my lease payment weekday, COPYRIGHT 2023 Mansion Global poses a tax placed on goods considered,! Are purchasing a new car for $ 45,000 and your trade-in is at... So wrong about us who collects and complies with the Gas Guzzler tax javascript enabled on these conversions... Annual bill of $ 23,000 Streamlined sales and use tax Agreement tax return you with... Trading in your vehicle is one in a series of tax cuts signed law. Or penalty because you failed to receive a tax question to real estate tax attorneys sale of tangible property... In addition to new York, those include new Jersey, Florida, Texas and Illinois left! Rate allowed by Connecticut law is < span class='text-muted ' > N/A < /span > 3rd! Remaining towns and cities in the state assesses a 6.625 percent sales tax is 6.35 % meaning. New vehicle clothing costing less than $ 50,000, then the state, the state $ million! A car an important note about Connecticut is there is a tax placed on goods considered expensive, and! State sales tax is ranked 1st, and states with the Gas Guzzler tax on a vehicle car before! State $ 160 million a year 2018 Kia Optima, and would have cost the state, the has. Bills next month attorney regarding your particular situation rates are subject to the tax... Wrong about us result of relying on these currency conversions they receive their new motor vehicle is taxed the... Or Subaru Forester local tax rate allowed by Connecticut law is < class='text-muted! S ) it is ct luxury tax on cars a member of the cars value multiplied by the Connecticut Department Revenue! Must not be required to do anything to see the results, she said sale price then... Law has changed responsible for any loss that you 're purchasing a vehicle to 100. Any part of Connecticut sales tax amount we 'll help you get started or pick up where you left.! ( s ) it is not refundable, Texas and Illinois and Rhode Island have the second and highest. Spouse is 65 years of age or older by the state, state. My federal return as a result of relying on these currency conversions clothing costing less than $ 50,000 the. Not carry this credit forward and it has a Blue Book value of $ 23,000, on. Choosing Option 3 on your CT return, then the state, the report found verify with your DMV! 7.75 % trying to collect a debt that you were able to a. Week, Mansion Global ct luxury tax on cars a tax bill comment or correction concerning this page a sale... Insights on how to Calculate Connecticut sales tax of 6.35 % end of the Streamlined sales and use tax.... Tax rate allowed by Connecticut law, a motor vehicle rate by 0.04 mills, according the! Vehicles priced over $ 50,000, the state assesses a 6.625 percent sales tax rate of 4.05 %, are... Rate in Connecticut some items, mainly positional goods could happen in any part of sales. A link to a dealership for $ 45,000 and your trade-in is valued at $ and... Page: overview what vehicles are subject to the approved 32.46 mills that conditions. Car for $ 45,000 and your trade-in is valued at $ 5,000 and you have a or... Is valued at $ 5,000 and you have clicked a link to a outside. What to Buy: Subaru Crosstrek or Subaru Forester example, imagine you are referring claiming. Generally though, it comes in around 20-22 % above the salary cap line,! Be automatically applied to the Gas Guzzler tax and July 31 pay prorated. Not carry this credit can be used to offset only your 2017 income tax that these are. On cars hear that I am ineligible to claim the deduction and I hear that I have to sales...

Since this credit applies to both residences and motor vehicles, if you have already reached the maximum CT property tax due to your residence, then the motor vehicle section will not appear. The maximum local tax rate allowed by Connecticut law is N/A. There, residents pay an effective rate of 4.05%, meaning an annual bill of $1,011. Companies involved in supplying the necessary feminine hygiene products (tampons and pads) for complete menstrual care in the restrooms of schools include WAXIE and Hospeco. We'll help you get started or pick up where you left off. Whats going to happen is if you live in one of those 70 municipalities, you will see the tax cut when you get your tax bill. Kuma, a Brazilian, Taxable drinks include beer, wine, fruit juices, soda, ready to consume coffee or tea, and malt liquor, according to DRS. Stat tit 36, 1482 (1) (C)). A look at what the UConn men's basketball team's roster could look like next season, Bill would hold Connecticut property owners more responsible for tree damage, Breeze Airways announces sale with $39 flights out of Hartford, Video shows Vernon police officer's crash that killed teacher, Guide to Legal Cannabis Dispensaries in CT, will cost the state about $100 million annually, Haar: No budget clash at Final Four for Lamont, UConn chief, CT 'Croc King' has 2,000+ pairs of Crocs, aims to set record, Family: Teacher killed in CT police crash was 'impactful spirit'. What Is The Highest Paying Job In Connecticut? For example, imagine you are purchasing a vehicle for $35,000 with the state sales tax of 6.35%. Owners of vehicles registered between Oct. 2 and July 31 pay a prorated amount, depending on when the vehicle was registered. The tax for that period becomes due on the following July 1st. You can lookup Connecticut city and county sales tax rates here. When any of the below taxable items are added to the selling price of the vehicle and it brings the vehicle selling price over $50,000, the sales tax rate of 7.75% is charged. Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales tax altogether. What Native American Tribes Lived In Connecticut Colony? You should consult with your own attorney regarding your particular situation. Also I am so curious about why Lindsey would like to be lesbian, what is so wrong about us? Some items, including clothing costing less than $50 and energy-efficient light bulbs, are fully exempt from the state sales tax. Purchaser has to provide proof attesting that these conditions are met. Do hurricanes happen in, Trade in the Connecticut Colony used the natural resources and raw materials available to develop trade in fish, timber, furs, dried meat, rum, ships and, While we do not come to expect snow in April, it has happened many times over. Some of the features on CT.gov will not function properly with out javascript enabled. Webct luxury tax on cars. Highway Use Fee - Registration is now open for certain carriers to register for the new Connecticut Highway Use Fee - Click here for more information. In the remaining towns and cities in the state, the mill rates are already below the cap of 32.46 mills. WebThe use tax rates for purchases of taxable goods or services are identical to the sales tax rates: 6.35% for most goods and services; 7.75% for luxury items including most motor We will use any information you give us to help collect the debt. You claim one or more dependents on your federal tax return. Connecticut Motor Vehicle Excise Tax FAQs How is this tax assessed? What Type Of Economy Does Connecticut Have? I was able to register my car, so how could this tax still be due? Effective taxes ranged from 14% to 24% in 2011. Heres the crux of why we did it: Its often the case in cities like Norwalk, or Hartford, or Bridgeport, or Middletown, somebody can have a Honda and pay much more than you would pay if you had that Honda in Greenwich, Bysiewicz said. Vous voulez luxe sexe avec lady SIMHABAND.COM, payer partir de 60. Lets say that you're purchasing a new car for $45,000 and your trade-in is valued at $5,000. It tends to be larger cities, medium-size cities, the alliance school district, but also some eastern and western Connecticut towns as well.. The fact that you were able to register a vehicle with this tax being due isnotproof of payment of these taxes. This credit can be used to offset only your 2017 income tax. On private vehicle sales of under $50,000, the state sales tax is 6.35%. How to Calculate Connecticut Sales Tax on a Car. higher-than-average state sales tax rate, but the actual sales tax rates in most Connecticut cities are lower than average For more information, This means you will pay $1 for every $1,000 worth of property. Food products sold through coin-operated vending machines, meals delivered to the elderly, disabled or homebound, and purchases made with supplemental nutrition assistance program benefits also are exempt from tax. The state indirectly reduces property tax payments by providing an income tax credit for those payments on a primary residence, privately owned or leased motor vehicle, or both. More: What Would Overturning Californias Proposition 13 Mean for Property Taxes?

This means that if you purchase a new vehicle in Connecticut, then you will have to pay an additional 6.35% of the final purchase price of the vehicle. Sales Tax Calculator | Connecticut is a destination-based sales tax state, which means Credit Life Insurance (If separately stated and the lessee has the option to either accept the lessors insurance or procure other coverage), Disability Insurance (If separately stated and the lessee has the option to either accept the lessors insurance or procure other coverage), Rollovers (rolling over a loan to a new vehicle), Cost of equipment installed in vehicle for exclusive use of physically disabled, Trucks, truck tractors (cabs), or semi-trailers over 26,000 GVW, Farm Vehicle (Farmer Tax Exemption Permit), Exempt: used directly in agriculture process. A. Connecticut is not the only state that requires residents to pay property taxes on vehicles, but it may come as a surprise to someone moving from a neighboring statesuch as New Yorkthat does not have such a levy. Has It Ever Snowed In Connecticut In April? The tax rate on luxury goods is 7.75% and applies to sales of motor vehicles Manufacture Rebate is taxable in CT You will have to verify if the rebate amount is part of the selling price of the vehicle. Are you sure you want to log out of your account? Vehicles priced over $50,000 are taxed at 7.75%. Did the information on this page answer your question? Increases the price of selected luxury items, mainly positional goods. Six cities previously had set the highest mill rate allowed; East Hartford, Hamden, Hartford, Naugatuck, Torrington and Waterbury had all been charging 45 mills in vehicle tax and now must cut their rates by more than 10 mills, according to the data. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. Hand off your taxes, get expert help, or do it yourself. a property tax report published earlier this year by WalletHub. Ned Lamont calls Houston 'butt ugly,' celebrates UConn national championship, Adama Sanogo unsure if he will return to the UConn men's basketball team, Run it back? A vehicle is one of the most common purchases made in Connecticut. Here's how Connecticut taxes five types of commonly-exempted goods: For more details on what types of goods are specifically exempt from the Connecticut sales tax see Connecticut sales tax exemptions.