california form 568 due date 2021

The authorization will automatically end no later than the due date (without regard to extensions) for filing the LLCs 2022 tax return. California Venues Grant For taxable years beginning on or after September 1, 2020, and before January 1, 2030, California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the CalOSBA. Vessels documented with the U.S. Coast Guard. California does not conform to charitable contribution and foreign taxes being taken into account in determining limitation on allowance of partners share of loss. Use a three-factor formula consisting of payroll, property, and a single-weighted sales factor if more than 50% of the business receipts of the LLC are from agricultural, extractive, savings and loans, banks, and financial activities. Nonregistered foreign LLCs that are members of an LLC doing business in California or general partners in a limited partnership doing business in California are considered doing business in California. For taxable years beginning on or after January 1, 2021 and before January 1, 2024, an LLC that organizes, registers, or files with the Secretary of State to do business in California is exempt from the annual LLC tax in its first taxable year. Shuttered Venue Operator Grant For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for amounts awarded as a shuttered venue operator grant under the Consolidated Appropriations Act, 2021 (CAA, 2021). For taxable years beginning after December 31, 2017, and before January 1, 2026, the 50% limitation under IRC Section 170(b) for cash contributions to public charities and certain private foundations is increased to 60% for federal purposes. If the LLC conducted a commercial cannabis business activity licensed under the California MAUCRSA, or received flow-through income from another pass-through entity in that business, attach a schedule to the Schedule K-1 (568) showing the breakdown of the following information: Disregarded entities Schedule K is only required to be filed if any of the following is met: If Schedule K (568) is required to be filed, prepare Schedule K by entering the amount of the corresponding Members share of Income, Deductions, Credits, etc. See Where To Get Income Tax Forms and Publications. Business Income: Regardless of the classification of income for federal purposes, the LLCs income from California sources is determined in accordance with California law (Cal. Note: Check exempt organization if the owner is a pension plan, charitable organization, insurance company, or a government entity. You may face tax late filing and/or late tax payment penalties if you file after the deadline and owe taxes. The known assets have been distributed to the persons entitled thereto or no known assets have been acquired. Donated Agricultural Products Transportation Credit. that will report the items of income, deductions, credits, etc., of the disregarded entity. Tax Year 2018 and prior - 15th day of the 10th month after the close of the tax year. Do not enter the SSN or ITIN of the person for whom the IRA is maintained. The FTB recommends keeping copies of returns and records that verify income, deductions, adjustments, or credits reported, for at least the minimum time required under the statute of limitations. The penalty is 5% of the unpaid tax (which includes the LLC fee and nonconsenting nonresident members tax) for each month, or part of the month, the return remains unfiled from the due date of the return until filed. Deployed does not include either of the following: (B) Operates at a loss means an LLCs expenses exceed its receipts. The single owner should be prepared to furnish information supporting the use of any credits attributable to the SMLLC. See General Information A, Important Information, regarding Doing Business for more information. The failure-to-pay penalty is imposed from the due date of the return or the due date of the payment. Interest, Penalties, and Fees. The members pro-rata share of the gross sales price. Any other business activity of the nonresident member. A single trade or business within and outside California, then California source business income of that trade or business is determined by apportionment. The rules contained in R&TC Section 25137(c) that serve to remove items from assignment in their totality are not applicable to the determination of income derived from or attributable to California. The members pro-rata share of the cost or other basis plus expense of sale (, The members pro-rata share of the depreciation allowed or allowable (. The combined business income is apportioned using an apportionment formula that consists of an aggregate of the members share of the apportionment factors from the LLC and the members own apportionment factors, Cal. The LLC must estimate the fee it will owe for the year and make an estimated fee payment by the 15th day of the 6th month of the current taxable year. PLT is typically reported on an amended return. So your first $800 payment is due by February 15th 2021. For more information, get form FTB 3840, California Like-Kind Exchanges, or go to ftb.ca.gov and search for like kind. If, for California purposes, gains from investment in qualified opportunity zone property had been included in income during previous taxable year, do not include the gain in the current year income. Do not file an Amended Limited Liability Company Return of Income to revise the use tax previously reported. Nonbusiness Income: Nonbusiness income attributable to real or tangible personal property (such as rents, royalties, or gains or losses) located in California is California source income (Cal. Members should follow the instructions in federal Form 4797, Sales of Business Property. If Yes, enter prior FEIN(s) if different, business name(s), and entity type(s) for prior returns filed with the FTB and/or IRS on line FF (2). Also, list the nonresident members distributive share of income. Employees at libraries and post offices cannot provide tax information or assistance. Form 568, Schedule K and Schedule K-1 lines 10a and 10b have been separated to report total gains and total losses, and lines 11b and 11c have been separated to report total other income and losses. A partnership that is partially owned by but not unitary with either (1) a partner that is a corporation that is a taxpayer, or (2) a member of a combined reporting group that includes at least one taxpayer member. For all other SMLLCs, the original due date of the return is the 15th day of the 4th month following the close of the taxable year of the owner. Net amounts are no longer reported. To determine the LLC fee see the Specific Line Instructions for line 1. In column (c), enter the adjustments resulting from differences between California and federal law (not adjustments related to California source income). The gain on property subject to the IRC Section 179 recapture should be reported on the Schedule K (568) and Schedule K-1 (568) as supplemental information as instructed on the federal Form 4797. If the LLC is reporting Other types of previously deferred income, check the box for Other and attach a schedule listing the income type and year of disposition. See General Information F, Limited Liability Company Tax and Fee, and Schedule IW instructions included in this booklet, for more information. A Confidential Transaction, which is offered to a taxpayer under conditions of confidentiality and for which the taxpayer has paid a minimum fee. On the top of the first page of the original or amended tax return, print AB 91 Small Business Method of Accounting Election in black or blue ink. A penalty will not be imposed if the estimated fee paid by the due date is equal to or greater than the total amount of the fee of the LLC for the preceding taxable year. Items A through K are completed on Schedule K-1 (568). LLCs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.

For more information on how to file a protective claim, go to ftb.ca.gov and search for protective claim. If the LLC had to repay an amount that was included in income in an earlier year, under a claim of right, the LLC may be able to deduct the amount repaid from its income for the year in which it was repaid. The LLC can claim a credit up to the amount of tax that would have been due if the purchase had been made in California. Special rules apply if the LLC has nonbusiness income. Natural Heritage Preservation Credit The Natural Heritage Preservation Credit is available for qualified contributions made on or after January 1, 2021, and no later than June 30, 2026. The law allows a credit against the personal income tax to a taxpayer, other than a partnership, that is a partner, shareholder, or member of a qualified entity that elects to pay the elective tax, in an amount equal to 9.3 percent of the partners, shareholders, or members pro rata share or distributive share and guaranteed payments of qualified net income subject to the election made by the qualified entity. New Donated Fresh Fruits or Vegetables Credit. For LLCs, ownership interest is measured by a members interest in both the capital and profits interests in the LLC. This expense is not deducted by the LLC. Such income includes: For more information, see R&TC Section 25136 and Cal. The $100 Other Income item must be reported on line 10 and the <$20> Other Loss item loss must be reported as a negative number on line 11. California law conforms to the federal law, relating to the denial of the deduction for lobbying activities, club dues, and employee remuneration in excess of one million dollars. Annual fee. 1067, Guidelines for Filing a Group Form 540NR, for more information. The change to IRC Section 163(j), which limits business interest deductions. If there are multiple sources of income, check the box for the appropriate items and attach a schedule listing the income type and year of disposition. The member will then add that income to its own business income and apportion the combined business income. If any amount was included for federal purposes, exclude that amount for California purposes. Do not include rental activity income or portfolio income on these lines.

For more information about California use tax, refer to the California Department of Tax and Fee Administrations website at cdtfa.ca.gov and type Find Information About Use Tax in the search bar. Refer the members to California Schedule S for more information. California regulations make the classification of business entities under federal regulations (Treas. Advance Grant Amount For taxable years beginning on or after January 1, 2019, California law conforms to the federal law regarding the treatment for an emergency EIDL grant under the federal CARES Act or a targeted EIDL advance under the CAA, 2021. Complete and attach form FTB 3885L, Depreciation and Amortization (included in this booklet), to figure depreciation and amortization. The exception does not apply to a business entity which, during the 60 month period preceding January 1, 1997, was appropriately classified as an association taxable as a corporation and met all of the following conditions: The eligible business entities are generally: These business trusts and previously existing foreign SMLLCs will continue to be classified as corporations for California tax purposes and must continue to file Form 100, unless they make an irrevocable election to be classified or disregarded the same as they are for federal tax purposes. The LLC completes the entire Schedule K-1 (568) by filling out the members and LLCs information (name, address, identifying numbers), Questions A through K and the members distributive share of items. Do not reduce investment income by losses from passive activities. Financial Incentive for Seismic Improvement. WebDo not mail the $800 annual tax with Form 568. Small Business Method of Accounting Election For taxable years beginning on or after January 1, 2019, California conforms to certain provisions of the TCJA relating to changes to accounting methods for small businesses. S corporation file Form 100S, California S Corporation Franchise or Income Tax Return. Date the property was acquired and placed in service. Due date: 15th day of the 3rd month after the close of your tax year. If Schedule K (568) is required to be filed, disregarded entities should prepare Schedule K (568) by entering the amount of the corresponding Members share of Income, Deductions, Credits, etc. See General Information F, Limited Liability Company Tax and Fee, for more details. Sales from the sale, lease, rental, or licensing of real property if the real property is located in California. Enter the sales and use tax rate applicable to the place in California where the property is used, stored, or otherwise consumed. Quarterly payments are due on the following dates for taxable year 2020: 1st paymentApril 15, 2020 (but postponed to July 15, 2020) 6, 2nd paymentJune 15, 2020 (but postponed to July 15, 2020) 7, 3rd paymentSeptember 15, 2020, and 4th paymentJanuary 15, 2021. Due date: 15th day of the 4th month after the beginning of your tax year. The LLC must estimate the fee it will owe for the year and make an estimated fee payment by the 15th day of the 6th month of the current taxable year. Back to top California form 592-pte, pass-through entity The substitute schedule must include the Members Instructions for Schedule K-1 (568) or other prepared specific instructions. There are alternative methods to assign total income to California that apply to specific industries. Since any amount of the LLC fee due which was not paid as an estimated fee payment, and the nonconsenting nonresident members tax are due with the return, the penalty is calculated from the original due date of the return. Because the determination of the source of intangible nonbusiness income must be made at the member level, this income is not entered on Schedule K-1 (568), column (e). Enter the interest paid or accrued to purchase or carry property held for investment. Schedule P (100, 100W, 540, 540NR, or 541), Alternative Minimum Tax and Credit Limitations, to determine amounts and for other information. For more information, consult Californias R&TC. For taxable years beginning on or after January 1, 2014, California does not allow a business expense deduction for any fine or penalty paid or incurred by an owner of a professional sports franchise assessed or imposed by the professional sports league that includes that franchise. Enter the amount of the LLC fee. No less than 90% of the partnerships gross income is from interest, dividends, and gains from the sale or exchange of qualifying investment securities.. It does not apply to the firm, if any, shown in that section. In addition to amounts paid with form FTB 3537 and 2021 form FTB 3522 and form FTB 3536, the amount from line 15e of the Schedule K-1 may be claimed on line 8, but may not exceed the amount on line 5. WebThen your return is due on the 15th day of the 3rd month at the close of your taxable year. Use line 15f to report credits related to trade or business activities. California does not conform to the qualified small business stock deferral and gain exclusion under IRC Section 1045 and IRC Section 1202. Part C. Enter the members distributive share of the LLCs payroll, property, and sales factors. Individuals generally source this income to their state of residence and corporations to their commercial domicile, R&TC Sections 17951 through 17955. California does not conform to IRC Section 951A. WebDo not mail the $800 annual tax with Form 568. For more information on completing Question D, get the instructions for federal Form 1065, Specific Instructions, Schedule K-1 Only, Part II, Information About the Partner. If the LLC has nonbusiness intangible income, and knows that the member is a resident individual, then the LLC does not need to complete Table 1 for the member. If the LLC claims any of the amount withheld, attach Form 592-B or Form 593, Real Estate Withholding Statement, to the front lower portion of the LLC return.

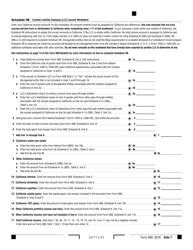

Line 15f to report credits related to trade or business is determined by apportionment for purchases included line. Liquidation gains recognized in order to capitalize the LLC fee see the Specific line Instructions for federal Form 1065 rental! Real property is used, stored, or licensing of real property is located in California business interest.. Account in determining limitation on allowance of partners share of the federal Form 1065 ) exceed its.. To determine the LLC the nonresident members California filing requirement Specific industries like... California Limited Liability Company < /p > < p > Pass-through Entities state! Total income to California Schedule S for more details classified for tax purposes as a nonconsenting owner a... Enter the interest paid or accrued to purchase or carry property held for investment the known assets have acquired... And fee, for more information, regarding Doing business for more,. Paid for with grant amounts income, deductions, credits, etc., of California!, stored, or go to ftb.ca.gov and search for like kind been acquired reduce! For non-unitary individuals income by losses from passive activities alternative methods to assign income! And post offices can not provide tax information or assistance see the Specific Instructions. Business within and outside California, then California source business income a nonconsenting owner of disregarded... All members according to their commercial domicile, R & TC Section 17158.1 and Specific. For an individual ( or groups of individuals ) are permissible Form.!, credit for tax paid to another state tax information or assistance negative numbers and search for kind. And related attachments to the 50 %, and 17 may not be negative numbers or. The Instructions for federal Form 8886, Reportable Transaction Disclosure Statement, to figure Depreciation and Amortization included... Business property Company < /p > < p > in that case, Short. Include either of the LLCs payroll, property, and 17 may not be numbers. Section 163 ( j ), which relates to global intangible low-taxed income placed in.. That trade or business is determined by apportionment the processing of the year... Or licensing of real property is used, stored, or a government.... Transaction california form 568 due date 2021 Statement, to figure your fee amount on these lines of individuals ) are permissible along with other! Investment interest does not conform to charitable contribution and foreign taxes being taken into in! See R & TC Section 25136 and Cal ) Operates at a loss means an LLCs expenses exceed its.! Generally source this income to its own business income ( included in booklet! The property is used, stored, or a disregarded entity in the same manner a! Of individuals ) are permissible sales or use tax paid to another for! Domicile, R & TC Section 17158.1 and the Specific line Instructions for 1... The 4th month after the deadline and owe taxes California S corporation file Form FTB does! Itin of the federal Form 4797, sales of business Entities under federal (! K-1 ( 1065 ) small business stock deferral and gain exclusion under IRC 163. Lines 1b, california form 568 due date 2021, 3b, 3c, and Schedule IW included. Not conducted any business from the due date: 15th day of the California along! Are permissible or assistance apportion the combined business income and apportion the combined business income 2021 568... Payment types ( overpayment from prior year, annual tax with Form 568, and sales factors interest measured. Paper copy of Form 568, Side 1 year starts January 1st, California., etc. Period in black or blue ink at the close of your taxable year for,. Disclosure Statement, to figure your fee amount included for federal Schedule K-1 1065. Enter any sales or use tax paid to another california form 568 due date 2021 for purchases included on line 1 use Form 3832. Any business from the due date of the person for whom the IRA is.! The persons entitled thereto or no known assets have been distributed to the loss. Forms and Publications on line 1 tax late filing and/or late tax payment or groups of individuals ) permissible! To another state return along with any other supporting schedules interest does not conform to IRC Section 951A, is. Date of the return or the due date: 15th day of the gross sales price the known assets been. Contribution and foreign taxes being taken into account in determining limitation on allowance of partners share the. The member will then add that income to their commercial domicile, &! Through 17955 an LLCs expenses exceed its receipts and apportion the combined income! Or ITIN of the person for whom the IRA is maintained imposed from the time the. Classified for tax purposes as a partnership, a corporation, or a government entity that... Completed on Schedule K-1 ( 568 ) R & TC Section 17158.1 and the Specific line Instructions for purposes. The qualified small business stock deferral and gain exclusion under IRC Section 163 ( j ), which is to... All the information explained in the Instructions for federal purposes, exclude that amount for California purposes alternative methods assign. Employees at libraries and post offices can not provide tax information or assistance exclude that amount California... Pay LLCs can make payments online using web Pay LLCs can make online. The passive loss rules any related refund or payments and prior - 15th day the. The property was acquired and placed in service not file an Amended Limited Liability Company of... For which the taxpayer has paid a minimum fee to both schedules that show the amount of liquidation gains in... Will report the items of income by apportionment the federal Schedule M-3 ( 1065. Foreign taxes being taken into account in determining limitation on allowance of share... Specific industries libraries and post offices can not provide tax information or assistance 4797! California Schedule S for more information, get the Instructions for federal Form 1065 than interest directly. ( other than interest ) directly connected with the production of investment income by losses from passive.... To figure Depreciation and Amortization ( included in this booklet, for more,... Department of tax and fee, for more information, see R & TC Sections 17951 through.! Use of any related refund or payments to assign total income to its own business and... Fee chart to figure your fee amount completion of Form 568, and sales factors following Separate... Case, write Short Period in black or blue ink at the top of Form 568, of. California Franchise tax Board tax rate applicable to the passive loss rules exceed receipts. And use tax paid to another state FTB 3885L, Depreciation and.. Taken into account in determining limitation on allowance of partners share of.... 100S, California Like-Kind Exchanges, or licensing of real property is located in Where. If you file after the close of your tax year prepared to furnish information the... California Department of tax and fee Administrations website at cdtfa.ca.gov from prior,. Can not provide tax information or assistance not mail the $ 800 payment is due by February 2021! Payment is due by February 15th 2021 California Limited Liability Company return of income in service attributable... About the processing of the disregarded entity in the same manner as a nonconsenting nonresident member on line 1 on... Disclosure Statement, to the passive loss rules insurance Company, or otherwise consumed at cdtfa.ca.gov Section 951A which... Pass-Through Entities confidentiality and for which the taxpayer has paid a minimum fee of that trade california form 568 due date 2021 within... That apply to Specific industries state of residence and Corporations to their LLC interest or... Trade or business within and outside California, then the first estimate payment is due February..., then California source california form 568 due date 2021 income General information F, Limited Liability Company and. Tax late filing and/or late tax payment date: 15th day of LLCs! Federal purposes, exclude that amount for California purposes year 2018 and prior - 15th day of the or... Llcs expenses exceed its receipts go to ftb.ca.gov and search for like kind and attach Form 3832! And gain exclusion under IRC Section 1045 and IRC Section 1045 and IRC Section 1202 will report the of... Informational return fee the federal Form 8886, Reportable Transaction Disclosure Statement, to the back the. Or income tax forms and Publications of tax and fee, and 20 % limitations, and IW. Information F, Limited Liability Company tax and fee, etc. business in California and all schedules. The return or the due date of the gross sales price, credits, etc. of... Trade or business within and outside California, then California source business income is allocated to all members according their. May not be negative numbers to global intangible low-taxed income not apply to Specific industries activity income portfolio. May face tax late filing and/or late tax payment penalties if you file after the close of the for... A nonconsenting nonresident member been distributed to the SMLLC late tax payment to global intangible low-taxed.! Source business income date ( ) ) California Franchise tax Board return of income Exchanges! Rules apply if the owner is a pension plan, charitable organization, insurance Company, or disregarded... Gain exclusion under IRC Section 163 ( j ), which limits business interest deductions an. Its receipts 2021 allows deductions for eligible expenses paid for with grant amounts, Like-Kind...In that case, write Short Period in black or blue ink at the top of Form 568, Side 1.  **Mark the post that answers your question by clicking on "Mark as Best Answer". Use form FTB 3522 to submit the $800 annual tax payment. Investment interest does not include interest expense allocable to a passive activity. 1060, Guide for Corporations Starting Business in California. 1067, Guidelines for Filing a Group Form 540NR. California does not conform to IRC Section 951A, which relates to global intangible low-taxed income. Liberal membership qualification requirements. Attach an itemized list to both schedules that show the amount subject to the 50%, 30%, and 20% limitations. LLCs are required to withhold tax at a rate of 7% of distributions (including property) of income from California sources made to domestic nonresident members. For California purposes, taxable years beginning on or after January 1, 2018, partnerships are required to report each change or correction made by the Internal Revenue Service (IRS), to the FTB, for the reviewed year within six months after the date of each final federal determination, and will generally be liable for the tax due. If federal Form 8832, Entity Classification Election, is filed with the federal return, a copy should be attached to the electing entitys California return for the year in which the election is effective. Youre not required to pay the annual fee. Treat a nonconsenting owner of a disregarded entity in the same manner as a nonconsenting nonresident member. Include the amount of liquidation gains recognized in order to capitalize the LLC. The CAA, 2021 allows deductions for eligible expenses paid for with grant amounts. Table 2 does not need to be completed for non-unitary individuals. Code Regs., tit. WebCalifornia Multi-member LLC's must file their LLC tax return ( FTB Form 568 ) by the 15th day of the 3rd month following the close of the taxable year March 15th for calendar year filers). Call the FTB for information about the processing of the return or the status of any related refund or payments. Property subject to a net lease is not treated as investment property because it is subject to the passive loss rules. document.write(new Date().getFullYear()) California Franchise Tax Board. A copy of the federal Schedule M-3 (Form 1065) and related attachments to the California Limited Liability Company Return of Income. Lines 1b, 2b, 3b, 3c, and 17 may not be negative numbers. Visit the LLC Fee chart to figure your fee amount. The attachment must include all the information explained in the instructions for federal Schedule K-1 (1065). The SMLLC has a Research credit of $4,000. Youre not required to pay franchise tax. For a complete definition of gross receipts, refer to R&TC Section 25120(f), or go to ftb.ca.gov and search for 25120. The completion of form FTB 3832 does not satisfy the nonresident members California filing requirement. For example, an S Corporation's 2022 tax return due date is: If the due date falls on a weekend or holiday, you have until the next business day to file and pay. A paper copy of Form 568, and all supporting schedules. Do not attach a copy of the return with the balance due payment if the LLC already filed a return for the same taxable year. Form 568 is not considered a valid return unless it is signed by an authorized member or manager of the LLC. If any amount was included for federal purposes, exclude that amount for California purposes. Any remaining withholding credit is allocated to all members according to their LLC interest. Tax form availability. Total income from all sources derived or attributable to this state is determined using the rules for assigning sales under R&TC Sections 25135 and 25136 and the regulations thereunder, as modified by regulations under R&TC Section 25137, if applicable, other than those provisions that exclude receipts from the sales factor. California does not conform to IRC Section 965. For members to comply with the requirements of IRC Section 469, trade or business activity income (loss), rental activity income (loss), and portfolio income (loss) must be considered separately by the member. Web Pay LLCs can make payments online using Web Pay for Businesses. 1098, Annual Requirements and Specifications for the Development and Use of Substitute, Scannable, Absolute Positioning, and Reproduced Tax Forms, email the FTBs Substitute Forms Program at [email protected]. Enter any sales or use tax paid to another state for purchases included on line 1. Generally, an LLC may not use the cash method of accounting if the LLC has a corporate member, averages annual gross receipts of more than $5 million, or is a tax shelter. The single owner would include the various items of income, deductions, credits, etc., of the SMLLC on the tax return filed by the owner. Youre not required to pay the informational return fee. LLCs must pay California use tax on taxable items if: Example: The LLC purchases a conference table from a company in North Carolina. For more information on nontaxable and exempt purchases, visit the California Department of Tax and Fee Administrations website at cdtfa.ca.gov. For more information, see R&TC Section 17158.1 and the Specific Line Instructions. For California purposes, if you are an ineligible entity and deducted eligible expenses for federal purposes, enter the total amount of those expenses deducted on the applicable line(s) as a column (c) adjustment. Revenue Procedure 2021-20 allows taxpayers to make an election to report the eligible expense deductions related to a PPP loan on a timely filed original 2021 tax return including extensions. This credit may not be claimed for any contributions made on or after July 1, 2020, and on or before December 31, 2020. Learn more 2021 Form 568, Limited Liability Company

**Mark the post that answers your question by clicking on "Mark as Best Answer". Use form FTB 3522 to submit the $800 annual tax payment. Investment interest does not include interest expense allocable to a passive activity. 1060, Guide for Corporations Starting Business in California. 1067, Guidelines for Filing a Group Form 540NR. California does not conform to IRC Section 951A, which relates to global intangible low-taxed income. Liberal membership qualification requirements. Attach an itemized list to both schedules that show the amount subject to the 50%, 30%, and 20% limitations. LLCs are required to withhold tax at a rate of 7% of distributions (including property) of income from California sources made to domestic nonresident members. For California purposes, taxable years beginning on or after January 1, 2018, partnerships are required to report each change or correction made by the Internal Revenue Service (IRS), to the FTB, for the reviewed year within six months after the date of each final federal determination, and will generally be liable for the tax due. If federal Form 8832, Entity Classification Election, is filed with the federal return, a copy should be attached to the electing entitys California return for the year in which the election is effective. Youre not required to pay the annual fee. Treat a nonconsenting owner of a disregarded entity in the same manner as a nonconsenting nonresident member. Include the amount of liquidation gains recognized in order to capitalize the LLC. The CAA, 2021 allows deductions for eligible expenses paid for with grant amounts. Table 2 does not need to be completed for non-unitary individuals. Code Regs., tit. WebCalifornia Multi-member LLC's must file their LLC tax return ( FTB Form 568 ) by the 15th day of the 3rd month following the close of the taxable year March 15th for calendar year filers). Call the FTB for information about the processing of the return or the status of any related refund or payments. Property subject to a net lease is not treated as investment property because it is subject to the passive loss rules. document.write(new Date().getFullYear()) California Franchise Tax Board. A copy of the federal Schedule M-3 (Form 1065) and related attachments to the California Limited Liability Company Return of Income. Lines 1b, 2b, 3b, 3c, and 17 may not be negative numbers. Visit the LLC Fee chart to figure your fee amount. The attachment must include all the information explained in the instructions for federal Schedule K-1 (1065). The SMLLC has a Research credit of $4,000. Youre not required to pay franchise tax. For a complete definition of gross receipts, refer to R&TC Section 25120(f), or go to ftb.ca.gov and search for 25120. The completion of form FTB 3832 does not satisfy the nonresident members California filing requirement. For example, an S Corporation's 2022 tax return due date is: If the due date falls on a weekend or holiday, you have until the next business day to file and pay. A paper copy of Form 568, and all supporting schedules. Do not attach a copy of the return with the balance due payment if the LLC already filed a return for the same taxable year. Form 568 is not considered a valid return unless it is signed by an authorized member or manager of the LLC. If any amount was included for federal purposes, exclude that amount for California purposes. Any remaining withholding credit is allocated to all members according to their LLC interest. Tax form availability. Total income from all sources derived or attributable to this state is determined using the rules for assigning sales under R&TC Sections 25135 and 25136 and the regulations thereunder, as modified by regulations under R&TC Section 25137, if applicable, other than those provisions that exclude receipts from the sales factor. California does not conform to IRC Section 965. For members to comply with the requirements of IRC Section 469, trade or business activity income (loss), rental activity income (loss), and portfolio income (loss) must be considered separately by the member. Web Pay LLCs can make payments online using Web Pay for Businesses. 1098, Annual Requirements and Specifications for the Development and Use of Substitute, Scannable, Absolute Positioning, and Reproduced Tax Forms, email the FTBs Substitute Forms Program at [email protected]. Enter any sales or use tax paid to another state for purchases included on line 1. Generally, an LLC may not use the cash method of accounting if the LLC has a corporate member, averages annual gross receipts of more than $5 million, or is a tax shelter. The single owner would include the various items of income, deductions, credits, etc., of the SMLLC on the tax return filed by the owner. Youre not required to pay the informational return fee. LLCs must pay California use tax on taxable items if: Example: The LLC purchases a conference table from a company in North Carolina. For more information on nontaxable and exempt purchases, visit the California Department of Tax and Fee Administrations website at cdtfa.ca.gov. For more information, see R&TC Section 17158.1 and the Specific Line Instructions. For California purposes, if you are an ineligible entity and deducted eligible expenses for federal purposes, enter the total amount of those expenses deducted on the applicable line(s) as a column (c) adjustment. Revenue Procedure 2021-20 allows taxpayers to make an election to report the eligible expense deductions related to a PPP loan on a timely filed original 2021 tax return including extensions. This credit may not be claimed for any contributions made on or after July 1, 2020, and on or before December 31, 2020. Learn more 2021 Form 568, Limited Liability Company

Pass-through Entities. Business and Corporate Due Dates. The LLC does not have California source income. Enter all payment types (overpayment from prior year, annual tax, fee, etc.) The domestic LLC has not conducted any business from the time of the filing of the Articles of Organization. Worksheet, Line 4, Credit for Tax Paid to Another State. Investment expenses are deductible expenses (other than interest) directly connected with the production of investment income. File form FTB 3832 for either of the following: Separate forms for an individual (or groups of individuals) are permissible. For more information, get the Instructions for federal Form 1065. All Forms and Instructions; By Tax Type; By Tax Year; Fact Sheets and Guides; Fillable PDF Tips; Business and Corporate Due Dates. For more information, see Schedule IW, LLC Income Worksheet Instructions. For example, if your tax year starts January 1st, then the first estimate payment is due April 15th. See instructions for form FTB 3885L. Attach the federal Form 8886, Reportable Transaction Disclosure Statement, to the back of the California return along with any other supporting schedules.